What Is WETH (Wrapped Ethereum) and How Does It Work?

TL;DR

- What is WETH: WETH (Wrapped Ethereum) is an ERC-20 version of ETH that makes Ethereum compatible with decentralized finance (DeFi) applications, token swaps, and liquidity pools.

- How WETH Works: WETH is created by depositing ETH into a smart contract, which issues an equivalent amount of WETH. It can also be unwrapped back into ETH anytime by reversing the process.

- Key Benefits: WETH lets you use ETH in dApps, trade on DEXs, save on gas fees with Layer-2 networks, and provides compatibility with ERC-20 tokens for staking and liquidity pools.

You’ve just purchased Ether (ETH) and are eager to start staking, swapping tokens, or joining liquidity pools. But soon, you realize that not every decentralized exchange (DEX) or protocol supports ETH directly.

This is because ETH, the native cryptocurrency of Ethereum, isn’t compatible with the ERC-20 token standard used by most decentralized applications (dApps) and DeFi platforms.

Wrapped Ethereum (WETH) fixes this by offering a more versatile version of ETH, making it easier to use across the DeFi ecosystem.

In this article, you’ll learn what WETH is, how it differs from regular ETH, and the ways wrapped Ether facilitates a more efficient, interoperable blockchain experience.

What Is WETH (Wrapped Ethereum)?

Most major blockchains have wrapped versions of their native cryptocurrencies, such as Wrapped BNB, Wrapped AVAX, or Wrapped Fantom.

Similar to the concept of stablecoins being “wrapped USD” (since they are pegged to the value of the dollar), wrapped tokens like WETH are tokenized versions of cryptocurrencies that are pegged to the value of the original coin and can be redeemed for their original assets at any time.

Overview of WETH

Wrapped Ether (WETH) is an ERC-20 token that is pegged 1:1 to the value of ETH. It can be used to interact with DeFi protocols and applications whereas ETH, by itself, can’t be used in many dApps.

When you wrap ETH to create WETH, you’re essentially putting your ETH into a smart contract that issues you an equal amount of WETH in return. Think of it as putting ETH in a format that speaks the same language as all the dApps and protocols within the Ethereum ecosystem.

History and Development of WETH

The story of WETH began with the emergence of DEXs and the growing DeFi ecosystem around 2017. As developers started building more sophisticated applications on Ethereum, they encountered a significant roadblock: native ETH couldn’t be directly used in smart contracts designed for ERC-20 tokens.

The development of WETH was a community-driven solution to this challenge. It wasn’t created by a single entity or organization but rather evolved as a standard through the collaborative efforts of developers and projects within the Ethereum ecosystem.

The first widely adopted WETH contract was deployed by the 0x project team, which became the foundation for what we use today. The current deployed wrapped ETH contract can be found here.

How Does WETH Work?

Understanding the Mechanics

If you’re trying to wrap your head around wrapped Ether, it helps to know the difference between coins and tokens.

Coins have their own independent blockchains, like Bitcoin (BTC) on the Bitcoin network or ETH on Ethereum. They’re often used as currency to validate transactions. Tokens, on the other hand, are built on existing blockchains and can represent anything from digital assets to loyalty points.

WETH is essentially Ethereum in token form, following the ERC-20 standard. The wrapped ETH contract transforms native ETH into an ERC-20 compatible token through a secure and automated mechanism. This process solves a major issue with native ETH by creating a standardized version of ETH that can seamlessly interact with any application requiring ERC-20 tokens.

You start the wrapping process by depositing ETH into a specialized smart contract. This contract acts as a vault, holding the original ETH and issuing an equivalent amount of WETH in return. Think of it like depositing cash into an ATM and receiving a digital balance—except in this case, the process is entirely automated and trustless through smart contracts.

That said, it’s worth mentioning that WETH isn’t “pegged” in the traditional sense. Instead, it operates through a blockchain program (smart contract) that anyone can interact with. You deposit ETH, and the program automatically issues the equivalent amount of WETH. The reverse is also true—deposit WETH and you’ll receive the exact equivalent in ETH. There’s no admin, no centralized owner, and no way to modify, block, or censor the process unless the entire blockchain goes down.

This makes WETH fundamentally different from tokens like WBTC, which rely on centralized authorities or custodians to maintain their peg. WETH’s decentralized design is quite unique and is shared by other gas tokens like WMATIC, which operate in a similar trustless manner.

The wrapped ETH contract has two core functions: “deposit” (wrap) and “withdraw” (unwrap). When you send ETH to the deposit function, it mints WETH and sends it to your wallet. To convert back, the withdraw function burns your WETH and releases the corresponding ETH.

Key features of the WETH mechanism include:

- Smart contract security: Immutable and publicly verifiable contracts ensure safety.

- Automation: Wrapping and unwrapping are entirely automated.

- 1:1 parity: WETH is always backed 1:1 by ETH.

- Transparent reserves: Anyone can verify the ETH locked in the contract.

Whenever WETH is exchanged back into ETH, the WETH token is burned or removed from circulation to maintain its 1:1 equivalence with ETH. This mechanism ensures that WETH always reflects the value of ETH. Additionally, wrapped Ether can be acquired by swapping other tokens for WETH on an exchange.

Wrapped Ethereum (wETH) vs. Ethereum (ETH)

ETH serves as the native currency of the Ethereum network, essential for paying gas fees and securing the network through staking. It’s the fundamental building block of the Ethereum ecosystem, but ironically, it lacks compatibility with many DeFi applications built on its own blockchain.

WETH, on the other hand, functions as an ERC-20 token, making it compatible with most DeFi protocols and DEXs. This standardization allows WETH to interact seamlessly with smart contracts designed for token-to-token transactions, something native ETH cannot do.

While these two assets maintain the same value, their functionalities and use cases differ in several important ways, as highlighted below.

| Feature | Ethereum (ETH) | Wrapped Ethereum (WETH) |

| Transaction fees | Used to pay gas fees on the Ethereum network | Cannot be used for gas fees |

| Smart contract interaction | Limited functionality, not ERC-20 compatible | Fully compatible with ERC-20 smart contracts |

| Trading capabilities | Cannot be directly paired with ERC-20 tokens on DEXs | Easily tradable with other ERC-20 tokens |

| Conversion process | No conversion needed | Requires wrapping/unwrapping via smart contracts, incurring gas fees |

| Storage | Held directly in Ethereum wallets | Stored as a token balance in wallets, grouped with other ERC-20 tokens |

| Use cases | Cross-border transactions, store of value, payment for smart contract development, and participation in initial coin offerings (ICO) | Trade directly with other ERC-20 tokens on DEXs, provide liquidity in DeFi, staking, and yield farming |

Choosing between WETH or ETH often depends on your needs. For simple transfers or paying gas fees, ETH is the obvious choice. However, WETH becomes necessary if you’re planning to engage with DeFi protocols, provide liquidity on DEXs, or participate in token swaps.

Rather than thinking of it as ETH vs. WETH, consider them complementary. This dual-asset structure may seem a bit nuanced, but it unlocks the full range of possibilities within the Ethereum ecosystem.

Key Features and Benefits of WETH

Until Ethereum eventually upgrades its codebase to be ERC-20 compliant, making it unnecessary to wrap Ether for interoperability, WETH remains indispensable.

Here’s a detailed breakdown of wrapped Ether’s core features and the benefits of using WETH:

1:1 Value with ETH

WETH maintains a perfect one-to-one value with ETH thanks to a secure smart contract system.

Every WETH token is fully backed by an equivalent amount of ETH locked in the contract, guaranteeing price stability and predictability. This isn’t just a target—it’s built into the system, ensuring you can always rely on the value of your WETH.

ERC-20 Compatibility

Since the ERC-20 standard was created after Ether, ETH does not conform to it and cannot be directly used in dApps built for the ERC-20 standard.

By wrapping ETH into WETH, you can bridge your ETH holdings into the broader DeFi ecosystem without hassle. This includes trading on DEXs, participating in liquidity pools, or using WETH as collateral for loans.

Liquidity

Wrapped Ether is a popular option for liquidity pools on DEXs like Uniswap. Liquidity pools pair two tokens, and since WETH is the ERC-20-compatible version of ETH, it is widely used.

Liquidity pools depend on having a sufficient volume of tokens to allow traders to swap without causing significant price fluctuations. By depositing WETH into these pools, users provide the necessary liquidity, reducing slippage and enabling efficient transactions. Similarly, WETH’s presence in liquidity pools on automated market makers (AMMs) allows for continuous trading and helps maintain relatively stable prices across the market.

In addition to trading, WETH is commonly used as collateral on lending platforms like Aave and Compound. Users can borrow other tokens or earn interest on their WETH holdings, adding another layer of utility and liquidity to the ecosystem.

Trustless Smart Contracts

Wrapped Ethereum is not issued by a centralized party, like Circle or Tether. Wrapping and unwrapping WETH is handled entirely by smart contracts. Ethereum users can “wrap” their ETH manually by placing it into the smart contract, receiving the same amount of wETH in return. They can then swap back their wETH for ETH any time they want.

These smart contracts work automatically to:

- Verify every transaction on-chain

- Execute exactly as programmed

- Require no manual intervention

- Prevent unauthorized changes

This trustless system gives you full control over your WETH and eliminates the need for intermediaries or trust in centralized authorities.

Interoperability Across Chains

WETH isn’t just limited to Ethereum—its design allows it to work across different blockchains. By wrapping ETH, you’re making it compatible with a wider range of dApps, without losing the security or value of Ether.

With WETH, you can:

- Transfer value between blockchains: You can move WETH from Ethereum to Layer-2 networks like Arbitrum or Polygon using a crypto bridge. This allows you to save on gas fees while leveraging Ethereum’s value.

- Use cross-chain DeFi protocols: Platforms like Rubic Exchange and Stargate Finance enable you to use WETH in DeFi protocols across chains. You could stake WETH on Avalanche to earn rewards in a native Avalanche DeFi platform and participate in yield-generating activities.

- Access different ecosystems while keeping exposure to ETH: By wrapping ETH, you can explore ecosystems like Binance Smart Chain (BSC), Solana, or Base while maintaining ETH’s price exposure. You could use WETH to trade on Uniswap or interact with Solana-based protocols like Raydium.

- Use ETH’s value on new platforms and applications: WETH can be deployed on newer networks, such as Celo or TON, for liquidity provision or borrowing/lending. By depositing WETH as collateral, you can borrow Celo-native assets like CELO or CUSD to participate in Celo’s ecosystem, whether it’s for yield farming or making payments in dApps.

Another perk is how much you can save on gas fees. For newer users or those experimenting with dApps, gas fees on the Ethereum network can be intimidating.

WETH lets you sidestep some of these costs by moving to Layer-2 solutions like Polygon or zkSync, where transactions are faster and cheaper. This means that you can trade with WETH on Polygon and still get the same functionality as the Ethereum mainnet.

It’s faster, less hassle, and saves you from racking up unnecessary gas fees.

WETH also simplifies managing your crypto. Since it’s standardized as an ERC-20 token, it’s easier to track and transfer alongside your other tokens. You can manage everything in one wallet without juggling different formats or standards.

Risks and Drawbacks of Using WETH

While WETH offers significant advantages, it’s important to know the risks and challenges associated with its use.

- Smart contract vulnerabilities: WETH relies on smart contracts for wrapping and unwrapping ETH, which means any flaws or exploits in these contracts could result in the loss of funds. User errors, such as sending funds to the wrong address or interacting with malicious contracts, also pose risks.

- High fees and network congestion: Each wrap and unwrap transaction requires gas fees. These fees can skyrocket when there is heavy network activity, making small transactions impractical. Network congestion can also cause delays in unwrapping WETH, which could be a pain in time-sensitive situations.

- Additional complexities: Managing the wrap and unwrap process can add a layer of complexity, including tracking transactions for tax purposes. On top of that, smart contracts might occasionally be paused for maintenance, potentially leaving you without access to funds when you need them most.

Because WETH does not have a single custodian (again, unlike USDC or USDT), the token itself does not pose any systemic risk to the crypto space. However, it’s theoretically possible for some WETH tokens to lose value if their specific custodian loses the ETH backing the wrapped token.

While wrapped Ether is widely adopted and considered secure due to extensive audits, it’s not entirely without risks. Always verify contract addresses and understand how the process works before using WETH or engaging with any DeFi protocols.

Comparison with Other Wrapped Tokens

While WETH paved the way as the first widely adopted wrapped token, other wrapped versions of popular cryptocurrencies have since emerged to enable similar functionality across different blockchains.

Wrapped Bitcoin (WBTC) is one of the most prominent wrapped tokens, allowing Bitcoin holders to interact with Ethereum-based DeFi applications. Like wrapped Ether, WBTC maintains a 1:1 ratio with its underlying asset, but its wrapping process is fundamentally different. Unlike WETH’s trustless, smart contract-based system, WBTC relies on custodians and merchants to handle wrapping and unwrapping, which introduces an additional layer of centralization.

Other wrapped tokens include:

- Wrapped BNB (WBNB): Used within Binance Smart Chain (BSC) for trading, liquidity provision, and DeFi protocols.

- Wrapped SOL (WSOL): Enables Solana users to integrate SOL into Ethereum-compatible ecosystems.

- Wrapped AVAX (WAVAX): Bridges Avalanche assets into Ethereum’s DeFi landscape.

While these wrapped tokens share the primary goal of enabling cross-chain functionality, they differ in key areas:

- Wrapping mechanism: Some use trustless smart contracts (like WETH), while others depend on custodial solutions (like WBTC).

- Level of decentralization: Systems range from fully decentralized to partially centralized, depending on the blockchain’s design.

- Transaction speed: This varies based on the underlying blockchain’s efficiency and consensus mechanism.

- Cost: Wrapping fees and gas costs differ significantly across blockchains.

Wrapped tokens demonstrate how assets can retain value and utility while operating across ecosystems. However, every wrapped token implementation involves trade-offs between decentralization, security, and functionality.

Your choice of wrapped token can directly impact transaction costs, risk exposure, and potential returns. While WETH remains the most decentralized and battle-tested option, other wrapped tokens continue to evolve, refining their mechanisms based on lessons learned from the WETH model.

Current Market Data for WETH

Wrapped Ethereum (WETH) is pegged 1:1 to Ether, but minor fluctuations in its price—typically less than 1%—can occur. These variations are influenced by factors like Ethereum’s transaction fees, trading volumes, and liquidity conditions on centralized and decentralized exchanges.

Below is a daily chart comparing the price of WETH vs ETH.

Source: CoinGecko

At the time of writing, WETH has a market cap of $13.04 billion, which means roughly 3% of all Ethereum is locked as collateral to mint WETH.

One key trend is the steady rise in the number of WETH holders. As seen in the following chart, more than 200,000 unique addresses now hold at least $100 worth of WETH, and this number has continued to grow throughout 2024. This increase suggests increased adoption of WETH across a wide range of activities, from small-scale trading to staking in DeFi protocols.

The chart shows the sum of unique addresses holding at least $100 worth of WETH. Source: TradingView

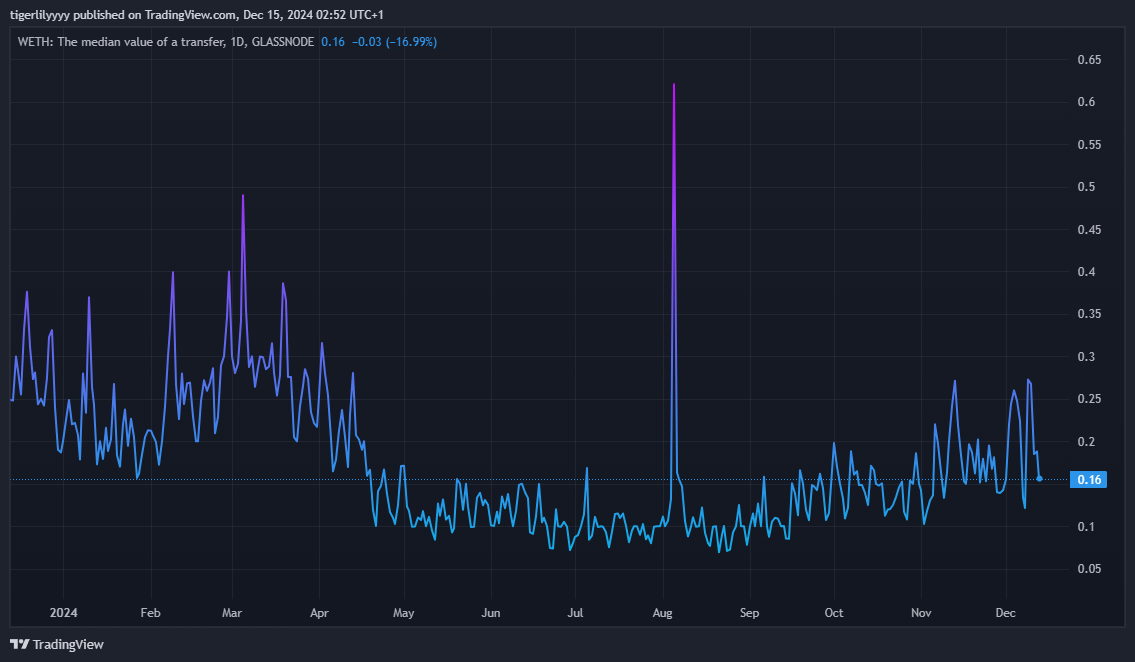

The current median WETH transfer value of 0.16 WETH provides insight into typical transaction sizes. At today’s ETH price of $3,963.36, this represents a transfer worth $634.14, which indicates that typical users are making moderately sized transactions rather than very small or extremely large ones. Transactions of this size are common for activities like NFT purchases, token swaps, or smaller-scale DeFi participation, which align with WETH’s role in the ecosystem.

Interestingly, the median transfer value has dropped from over 0.60 WETH in August 2024 to 0.16 WETH today (at the time of writing). This shift can be attributed to ETH’s price volatility during the same period. In August, users likely made larger transfers to take advantage of lower prices. As ETH’s price recovered to nearly $4,000, smaller transactions have become more common, reflecting adjustments to the higher dollar value of ETH.

Additionally, the ongoing bullish market trend has likely spurred higher transaction volumes as users capitalize on opportunities in DeFi.

The chart shows the median value of a WETH transfer, which has dropped significantly since August 2024. Source: TradingView

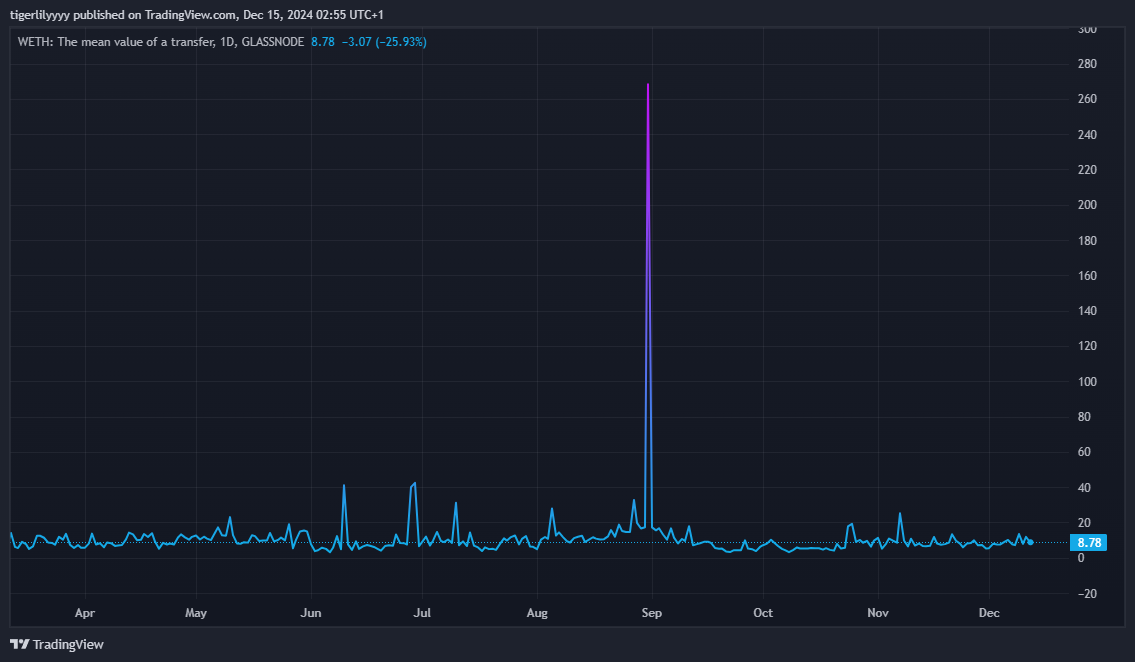

While WETH’s median transfer value suggests that smaller, retail-level transactions dominate the number of transfers, the high mean transfer value, currently at 8.78 WETH (around $34,541.90) points to occasional large-scale transfers, possibly liquidity provision, whale activity, or major trades.

More importantly, the contrast between the mean and median highlights a diverse user base of wrapped Ether. It’s being used for everything from small, frequent transactions to large-scale movements of WETH.

The chart shows the mean value of a WETH transfer. Source: TradingView

How to Wrap and Unwrap ETH

Steps to Wrap ETH

Converting ETH into WETH is a simple process that allows you to unlock the full potential of the Ethereum ecosystem. Many platforms make this process user-friendly, and Rubic Exchange is one of them.

On Rubic Exchange, wrapping ETH is quick, transparent, and doesn’t require registration.

Here’s a step-by-step guide to wrapping ETH on Rubic:

- Connect your wallet: Click the “Connect Wallet” button at the top of the page. Rubic supports popular wallets like MetaMask, Trust Wallet, and WalletConnect. Follow the prompts to connect your wallet securely

- Select ETH as the input token: In the “From” field, select ETH as the token you want to convert. This ensures you’ll be wrapping your Ethereum. Ensure you have enough ETH to cover both the conversion amount and gas fees

- Choose WETH as the output token: In the “To” field, select WETH as the token you want to receive. Rubic’s Smart Routing will automatically ensure you get the best conversion price for your transaction.

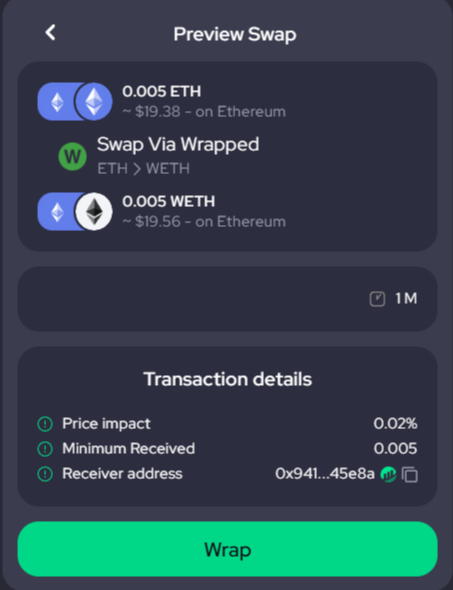

- Enter the amount of ETH to wrap: Input the amount of ETH you want to wrap into WETH. Rubic will show you the equivalent amount of WETH you’ll receive, accounting for any applicable network fees

- Review and confirm the transaction: Check the details of your transaction, including the gas fees and the amount of WETH you’ll receive. Mistakes, such as sending WETH to the wrong address, can result in the permanent loss of funds. Double-check the wallet and transaction details before confirming. Once everything looks good, click “Confirm” to initiate the wrapping process.

- Complete the wrap: Your wallet will prompt you to approve the transaction. Confirm it, and the transaction will be processed on the Ethereum network. Once it’s completed, the WETH will appear in your wallet.

Wrapping ETH requires a transaction on the Ethereum network, which incurs gas fees. During periods of high network congestion, these fees can spike significantly. To save on costs, consider wrapping ETH during off-peak hours.

Unwrapping WETH

Unwrapping WETH converts it back into native ETH, allowing you to use it for activities that require ETH directly, such as paying for gas fees or transferring funds outside the DeFi ecosystem.

The process to convert WETH to ETH on Rubic Exchange is exactly the same as wrapping ETH but in reverse.

To unwrap WETH, simply connect your wallet to the platform again and follow the steps mentioned above, but this time select WETH as the input token and choose ETH as the output token when conducting your swap. If WETH doesn’t appear, ensure it’s added to your wallet and that you have a balance available.

Rubic Exchange also lets you swap WETH for other popular tokens and cryptocurrencies. Some of the available trading pairs include: Bitcoin (BTC), Monero (XMR), Litecoin (LTC), Solana (SOL), Dogecoin (DOGE), Binance Smart Chain (BNB), and Ripple (XRP).

Wrapped Ethereum Use Cases

The primary use case of WETH is to enable the seamless exchange of Ether on DEXs and other Ethereum-based applications, such as DeFi protocols. Some specific use cases for WETH include:

1. Trading and liquidity provision on DEXs: Whether it’s Uniswap, Aerodrome, or Balancer, WETH serves as a key trading pair for countless ERC-20 tokens. For liquidity providers, WETH is often paired with other tokens in liquidity pools, such as WETH/USDC or WETH/DAI, allowing users to earn fees from trades on automated market makers (AMMs). For example, if you’re providing liquidity to the WETH/USDT pool on Uniswap, your WETH helps facilitate efficient trading between stablecoins and Ethereum-based assets, earning you a share of transaction fees.

2. Participate in DeFi platforms and protocols: Many DeFi protocols, such as lending platforms and liquidity pools, offer rewards for users who provide liquidity. In many cases, these rewards are denominated in a specific ERC-20 token. By converting ETH to WETH, you can:

- Earn interest: Deposit WETH into platforms like Aave or Compound to earn interest on your holdings.

- Borrowing collateral: Use WETH as collateral to borrow other cryptocurrencies, such as borrowing USDC for stablecoin trading.

- Yield farming: Stake WETH in liquidity pools to participate in yield farming on Curve or Pendle Finance.

- Liquidity mining: Earn governance tokens by providing WETH liquidity to platforms like Stargate Finance.

3. Microtransactions and gas fee optimization: WETH helps users save on gas fees by enabling more efficient transactions within the Ethereum ecosystem. This is especially useful for small, frequent interactions. By utilizing batching or Layer-2 solutions like Arbitrum or Optimism, you can reduce transaction costs significantly. For instance, if you’re executing multiple trades or flipping NFTs on a marketplace like OpenSea, batching these transactions with WETH on a Layer-2 solution can save time and money.

4. Gaming and NFTs: In blockchain-based games, WETH is commonly used for in-game purchases, P2P trading, and prize pools. For NFTs, WETH has also become a popular payment option on platforms like OpenSea and Rarible.

These use cases constantly evolve, opening up new possibilities for wrapped tokens like WETH. An interesting development is the rise of fractionalized NFTs, where WETH is being used to split ownership of high-value digital assets like blue-chip NFTs or virtual land.

While this lowers the barrier to entry for smaller investors, it’s also raising questions about what NFTs are supposed to be—unique ownership or something more like traditional shares? It’s a reminder of how wrapped tokens like WETH are shaking things up, creating new opportunities but also sparking fresh debates about what blockchain tech should really stand for.

Future Developments in WETH and Ethereum

The future of WETH is closely tied to ETH, and as Ethereum upgrades its infrastructure, several advancements are on the horizon that will likely influence how WETH functions and integrates with various applications.

Some key developments ahead include:

- Infrastructure upgrades: Ethereum’s Dencun upgrade earlier this year has already brought improvements, such as lower fees, particularly for Layer-2 solutions. While many of these changes are more behind-the-scenes and technical, they lay the groundwork for future upgrades that will have a greater impact on end users. The key takeaway is that when Ethereum’s upgrades benefit the network, those benefits extend even further when synchronized across Layer-2 chains and sidechains. These infrastructure enhancements—aimed at improving transaction processing and reducing data storage costs—are expected to make WETH transactions smoother and increase efficiency in DeFi applications.

- Interoperability goals: One big question for the future is whether Ethereum’s ongoing upgrades could reduce the need for WETH. If Ethereum becomes natively ERC-20 compatible, some of WETH’s current use cases might fade out. That said, this doesn’t mean WETH will disappear. Instead, it’s likely to adapt to new opportunities and use cases that emerge as Ethereum’s ecosystem continues to grow.

- Role in DeFi: WETH is crucial in providing liquidity to DEXs, liquidity pools, and other DeFi applications. It acts as a bridge between Ether and various ERC-20 tokens, enabling users to engage in trading, lending, and yield farming seamlessly. This established role suggests that WETH will remain relevant even as the DeFi landscape expands with new protocols and innovations.

- Future features: As Ethereum rolls out upgrades to improve scalability and transaction costs, WETH may evolve beyond its current functions. We could see new features focusing on efficiency, security, and user experience, keeping it central to the DeFi ecosystem.

Final Thoughts on Wrapped Ethereum

Wrapped Ethereum (WETH) has become a cornerstone of the Ethereum ecosystem, bridging the gap between ETH and ERC-20 tokens. It makes so much of what we do in DeFi possible. By wrapping ETH, you’re unlocking compatibility with the tools and applications that drive Ethereum’s innovation.

But WETH isn’t just a workaround. In a way, WETH is a perfect example of how Ethereum thrives—it’s a tool created by the community to solve a real need, and it’s grown into something far bigger. Whether you’re swapping tokens on a DEX or staking in DeFi, wrapped Ether has become an essential part of the experience.

Sure, the long-term goal is for native ETH to become ERC-20 compatible, but WETH seems to have the flexibility to adapt alongside Ethereum’s upgrades, finding new ways to add value as the ecosystem grows.

FAQs on What is Wrapped Ethereum (WETH)

1. WETH vs. ETH: Which one should I use?

It depends on what you’re trying to do. ETH is great for general use—paying for gas fees, making transactions, or holding as an investment. WETH, on the other hand, is designed specifically for DeFi and token trading on DEXs because it’s ERC-20 compatible.

2. Can I convert WETH back to ETH anytime?

Yes. The process is fully reversible. All you need to do is send your WETH to the smart contract, which will release the equivalent amount of ETH back to your wallet. It’s quick and simple, so you’re never locked into WETH.

3. Is WETH cheaper to use than ETH?

WETH and ETH have the same value at a 1:1 ratio. However, gas fees can be cheaper for WETH, especially if you’re using it on Layer-2 solutions like Polygon or Arbitrum. These networks reduce transaction costs significantly compared to using native ETH on the Ethereum mainnet. If you’re transacting on Layer-2, WETH is often the more cost-effective choice.

4. Can I use WETH in other blockchain networks?

Yes, you can. WETH is designed to be interoperable, allowing you to use your ETH on other blockchains like Polygon, Avalanche, or BNB Chain through blockchain bridges. By wrapping your ETH and moving it to these networks, you can access DeFi protocols, liquidity pools, and applications on those platforms while still holding the value of your Ethereum.