What Is Cross-Chain DeFi? A Comprehensive Guide (2025)

2022 was a challenging year for crypto, but amidst all the events of the past year, DeFi projects not only held on tight, but gained more strength and trust from crypto traders. Meanwhile, CeFi unexpectedly got a reputation as an unreliable and risky area, as we remember the Celsius crypto meltdown, FTX, Three Arrows Capital, and Voyager Digital. The crisis of trust in CeFi became a stimulus for DeFi. What are the next steps for DeFi projects? Can DEXs replace CEXs eventually? How can Cross-Chain DEXs help Web3 DeFi development?

Discover the power of cross-chain DeFi in this article!

The Vital Role of Cross-Chain Interoperability in DeFi

Cross-Chain DeFi by the Numbers: Trends and Statistics

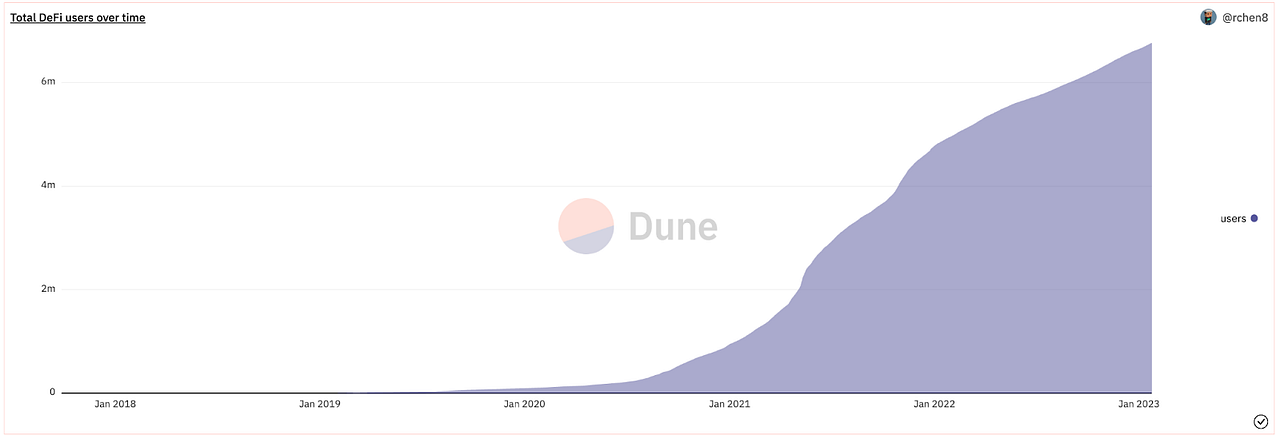

DeFi’s TVL is nearly $48 billion at the time of writing, according to DefiLlama. This is a sharp drop from the year’s outset, where it stood at $166.7 billion. Yes, DeFi lost 76% of TVL in dollar terms in 2022, but still, decentralized exchanges executed $854 billion in trading volume in 2022, and this came from 5,687,713 unique trading addresses (Source: https://dune.com/hagaetc/dex-metrics). Data from Dune Analytics shows that the total number of DeFi users has steadily increased throughout 2022.

DeFi’s growth shows no sign of slowing down. Despite market conditions, unique DeFi users have risen by 40% in 2022: from 4.7 million at the start of 2022, to almost 6 million, while the number of unique DeFi users has increased by nearly 600% over a two-year period, with just 940,000 users at the start of 2021.

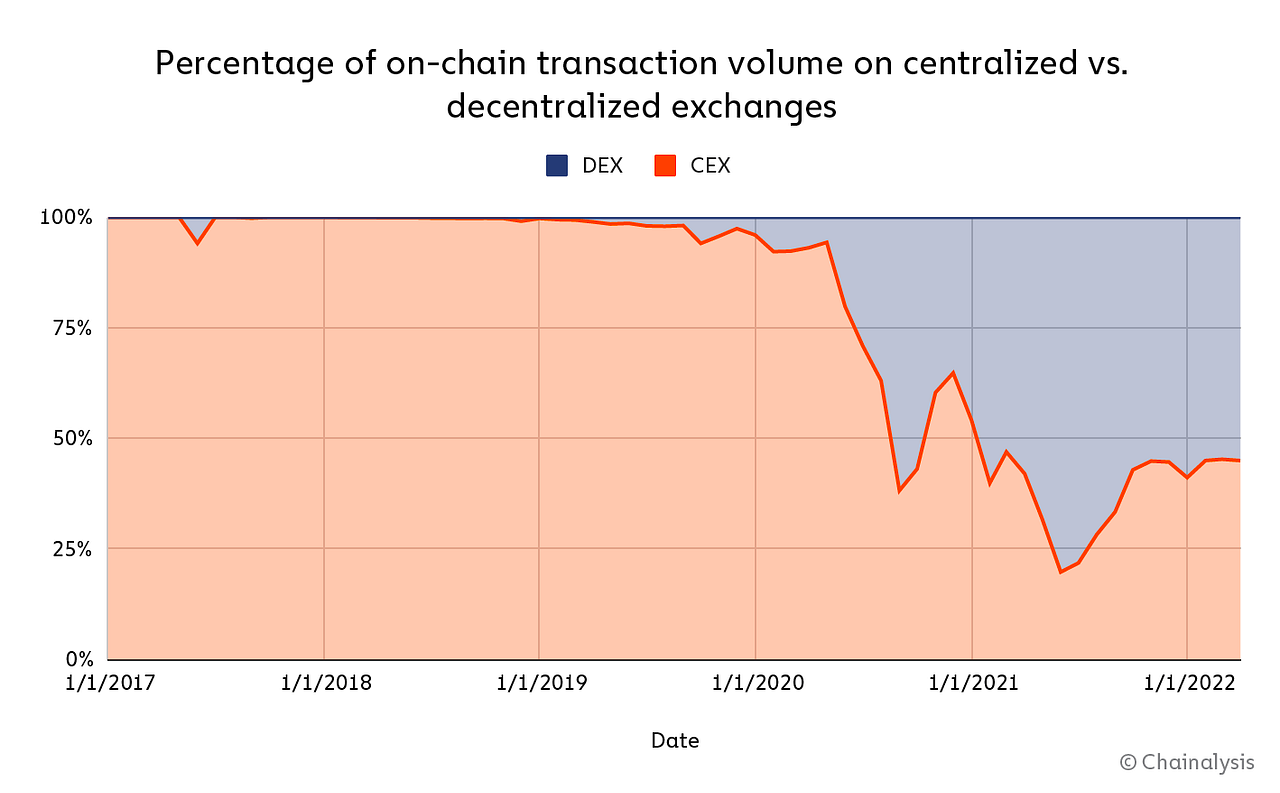

Obviously, DeFi is already the choice for most crypto traders. In fact, as we see in the case of DEXs vs. CEXs, decentralized cryptocurrency protocols have at times overtaken centralized services in on-chain transaction volume.

So, no wonder new DEXs keep appearing on the market. There are hundreds of DEX Protocols (665, according to DeFiLlama), and the main question is: Why do only a few of them have Cross-Chain interoperability when there’re already 164 chains?

Among all the commonly known reasons, such as anonymity and security, another reason trading volume has shifted from centralized exchanges to DEXs could be the latter’s greater number of assets on offer. It leads to another step in DEX Protocols’ development — allowing these assets to be transferred between different blockchains. There are several evident advantages for users when a DEX goes Cross-Chain:

- They can use their digital assets freely, and transfer tokens across different blockchains in a seamless and frictionless manner.

- They can decentralize their assets across different blockchains to minimize risk.

When the possibility of transferring tokens between different blockchains opens up for users, it leads to more advantages for the DEX itself:

- Easier user onboarding

- Additional volume and fees from cross-chain trading

- Diversification on different chains

- Cross-industry collaboration

Thus, it makes sense to make dApps Cross-Chain, as it’s already a must-have. Gaining cross-chain interoperability is an inevitable requirement if your project wants to be an indispensable part of Web3.

How Does Cross-Chain DeFi Work?

Cross-chain DeFi, or decentralized finance, operates by connecting and facilitating financial transactions and activities across multiple blockchain networks. This interoperability allows users to access a broader range of assets, liquidity, and services, transcending the limitations of a single blockchain.

In cross-chain DeFi, smart contracts and protocols are designed to operate seamlessly across different blockchains. This is achieved through the use of specialized technologies and standards that enable communication and asset transfers between disparate blockchain ecosystems.

Benefits of Cross-Chain DeFi

- Asset Interoperability: Cross-chain DeFi enables the transfer of assets between different blockchain networks, allowing users to access a diverse range of tokens and cryptocurrencies.

- Liquidity Aggregation: By connecting multiple liquidity pools across various blockchains, cross-chain DeFi platforms can aggregate liquidity, providing users with improved access to trading opportunities and better execution of transactions.

- Risk Diversification: Users can spread their assets and investments across multiple blockchains, reducing the impact of risks associated with a single blockchain’s performance or security vulnerabilities.

Types of Cross-Chain DeFi: Interoperability Mechanisms

- Wrapped Tokens: Wrapped tokens represent assets from one blockchain on another. For example, a wrapped Bitcoin (wBTC) on the Ethereum blockchain allows users to trade and use Bitcoin within the Ethereum DeFi ecosystem.

- Cross-Chain Bridges: These are protocols or smart contracts that facilitate the secure transfer of assets between different blockchains. Bridges ensure that assets are locked on one chain before being minted or issued on another.

- Interoperable Protocols: Some DeFi protocols are designed to be interoperable across various blockchains, enabling users to engage in decentralized lending, borrowing, or trading seamlessly.

Comparing Cross-Chain and Traditional DeFi: A Closer Look

In traditional DeFi, activities are confined to a single blockchain, limiting users to the assets and services available on that particular network. Cross-chain DeFi, on the other hand, expands these possibilities by connecting different blockchains.

While traditional DeFi platforms offer simplicity and familiarity, cross-chain DeFi provides enhanced flexibility and access to a more extensive range of assets. Users can choose between these approaches based on their specific needs and preferences in the decentralized financial landscape.

Cross-Chain vs. Multi-Chain Explained

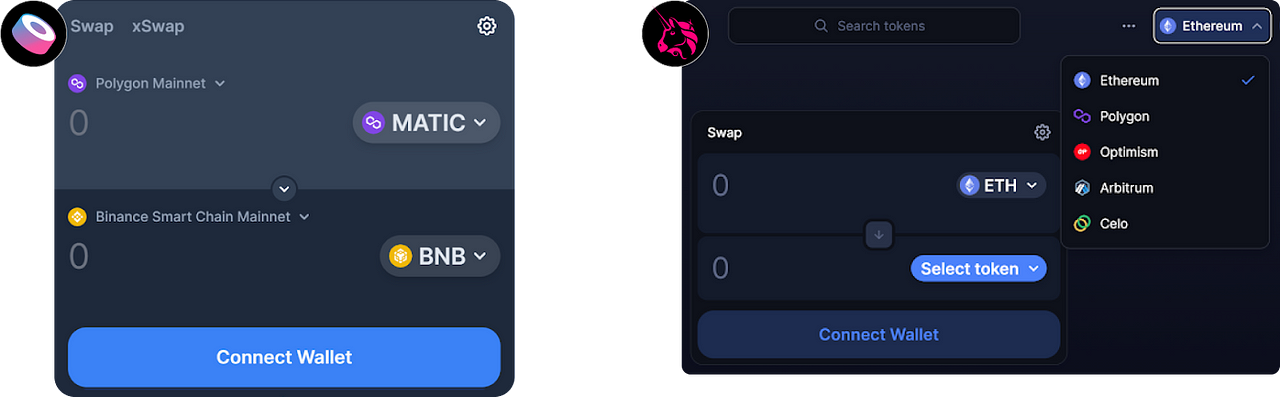

To figure out the difference between Multi-Chain and Cross-Chain Protocols, let us compare two top DEX market players: SushiSwap and Uniswap.

Uniswap is based on several blockchains (Ethereum, Polygon, Optimism, Arbitrum, Celo) and is considered to be a Multi-Chain Solution, as its liquidity is spread across chains. Basically, these are copies of Uniswap on different blockchains.

SushiSwap’s Cross-Chain architecture allows assets to flow between unrelated blockchains, with the help of smart contracts.

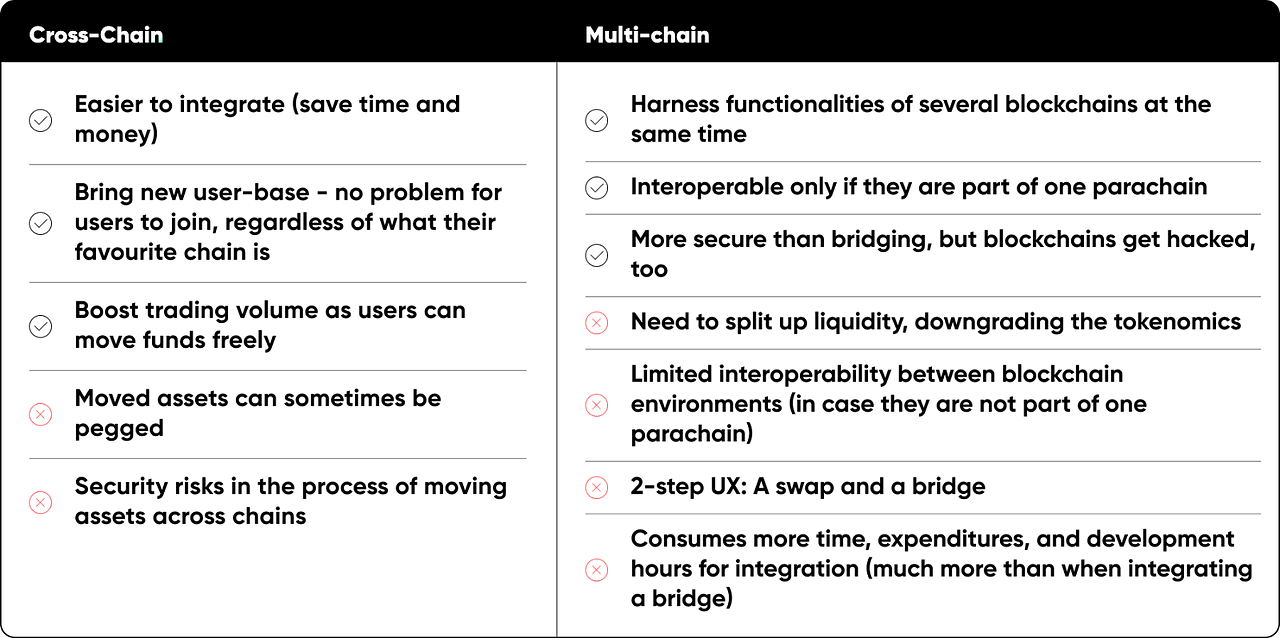

Let us sum up the pros and cons of Multi-Chain and Cross-Chain solutions:

So is there an easy way to make a DEX Cross-Chain?

Assessing the Safety of Cross-Chain Interoperability: Risks and Precautions

You can have a look at different cross-chain solutions which exist on the market right now in one of our latest articles: Rubic: A Cross-Chain Tech Aggregator for the Interoperable Future of Web3.

It may sound blatant, but Rubic Cross-Chain Tools are amongst the most convenient ways to go Cross-Chain for dApps. This is not only because Rubic is an aggregator of over 220+ bridges and DEXs, but also because of the quality and convenience of our Widget and SDK, which has already been battle-tested by over 130 crypto projects.

We provide an easy-to-install Widget for those who want to start their Cross-Chain journey right away, and an exquisite SDK for platforms who instead want a customized Cross-Chain solution adapted to their interface.

Now, it’s time to dive into the details of each tool and how it can help DEXs to go Cross-Chain.

Let’s recall what the general advantages are of getting Cross-Chain interoperability for a DEX. As we’ve said before, along with building connections between blockchains, when DEXs support Cross-Chain interoperability, it can receive easier user onboarding and extra trading volume + revenue.

However, our solutions offer even more features to our integrators:

- Fast One-Click Cross-Chain Swaps

Due to the aggregation of over 220+ DEXs and bridges, over 15,500 tokens are available across 70+ blockchains in one click, directly on your platform. The average transaction takes around 90 seconds.

- Ever-Lasting Liquidity

Even if your own DEX runs out of liquidity, due to the aggregation of DEXs and bridges within our app, Rubic will always provide you with liquid assets.

- Smart Routing: The Best Swap Deal

With Rubic’s Cross-Chain Tools, you get the best deals across 220+ DEXs & bridges integrated into Rubic.exchange. Aggregation allows the algorithm to find the best deal on the market for cross-chain and on-chain swaps. The algorithm used at Rubic splits and manages transactions as needed, to save on gas and fees as much as possible. Quick and effective pathfinding was built based on the architecture uniting and matching real-time data. Thus, the best DEX, bridge, transaction time, gas fee, and other parameters are chosen.

- Free & Easy Integration

You can turn your business into a cross-chain ecosystem hassle-free by integrating Rubic’s Widget via our user-friendly configurator, in just 10 minutes. Alternatively, you can spend more time integrating Rubic’s SDK, implementing a fully customized solution. Rubic’s team is going to assist you before, during, and after integration.

- Full UI/UX Customization

As a white-label solution, Rubic’s SDK can be easily implemented into your project’s environment by letting you write your own logic in the code regarding how users will go through each step when making a swap, giving you full control over your UI. You can fully customize Rubic’s SDK to your platform so that no one will ever notice it’s an integration.

Rubic’s Widget, with its minimalistic and classic design, will be a great fit for any project’s existing interface. The UX is clear and friendly to the extent that any crypto novice will understand how to make a cross-chain or on-chain swap.

- Enhanced Security

Rubic’s Cross-Chain Tools continue operating even if a bridge gets hacked, routing transactions through other bridges.

Rubic’s Widget and SDK are streamlined on all levels, in terms of caching and security: transactions are auto-monitored, and the auto-refund function is fully set up. Rubic’s technical support is also, of course, ready to assist you 24/7.

- Revenue & Customizable Fees

Up to 50% of the fees coming from trades via Rubic’s SDK/Widget go straight to your business. Besides the fees taken by Rubic, you may choose preferable additional trading fees that will be charged by your platform via Rubic’s Widget/SDK.

- Trading Volume Boost

With Rubic’s SDK, users will be able to buy the desired tokens right on your website, regardless of the blockchain they use. They won’t need to go to a bridge or any other external providers to swap assets at an unfavorable rate — they simply go to your website and make the best deal in one place. Thus, you will retain users and increase your trading volume.

Useful tip: If your DEX is already Multi-Chain, you can implement Rubic’s Cross-Chain solution, integrating only your own DEX for Cross-Chain Swaps, limiting the integration of other DEXs supported by our tools. In this case, you won’t share trading volume with other DEXs!

Over 130 projects have already become Cross-Chain with Rubic’s tools. For now, we will discuss one DEX in particular.

Kishu Inu: Implementing Cross-Chain Features in Your DeFi Project

Rubic Tools helped Kishu Inu revamp the already existing Kishu Swap Protocol, turning it into Kishu Swap X — an all-in-one cross-chain trading platform, where users can simply swap tokens from one chain to another, in just a few clicks. How did Kishu Inu manage to boost their DEX using Rubic tools, and what did it mean for Kishu Inu users?

What is Kishu Swap X?

Kishu Inu implemented Rubic’s SDK into their platform in December 2022. Currently, it’s known as Kishu Swap X.

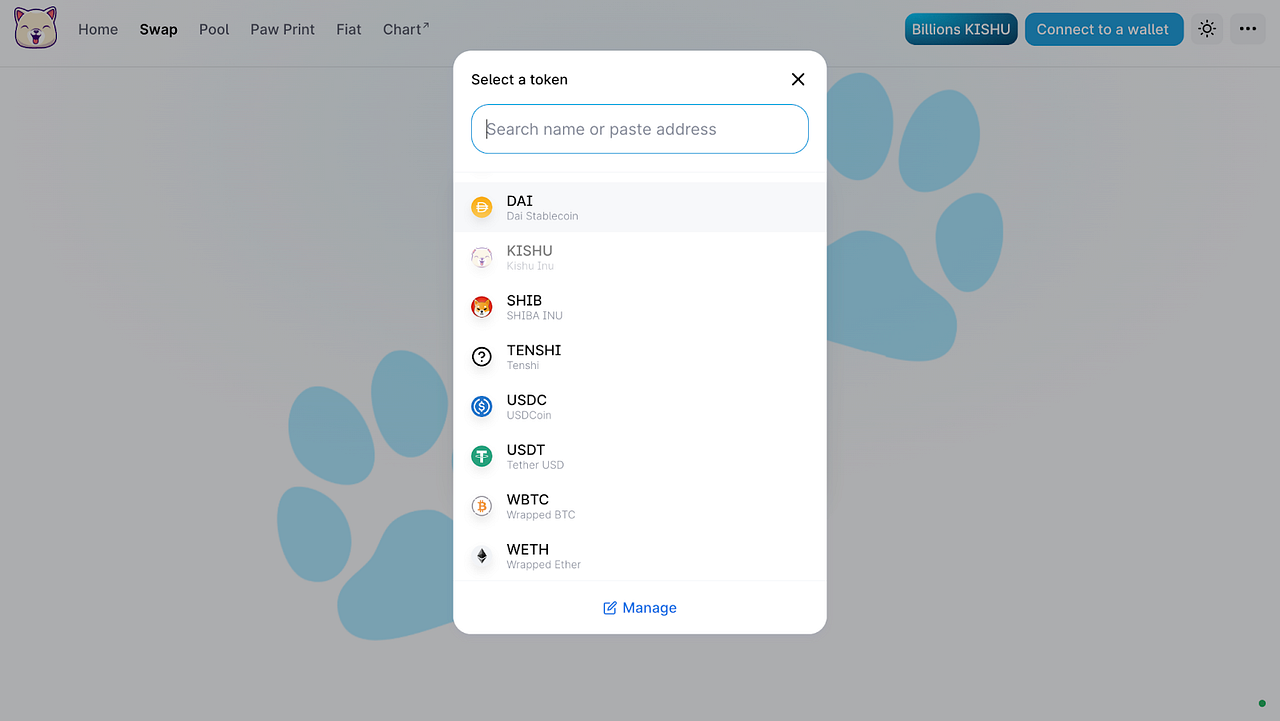

Kishu Swap X is the official DEX of the Kishu Inu community. Kishu Swap X offers users an all-in-one solution for a smoother trading experience:

- One-click swaps between 15,500+ tokens

- Cross-Chain swapping between 22+ different blockchains in one transaction

- Swapping at the best possible rates, using optimal routing and bridging systems, which automatically check for the most efficient methods to conduct the transaction

Kishu Inu DEX is supported by its native $KISHU token, which you can always get on Kishu Swap X (check our article about Rubic tools for tokenholders).

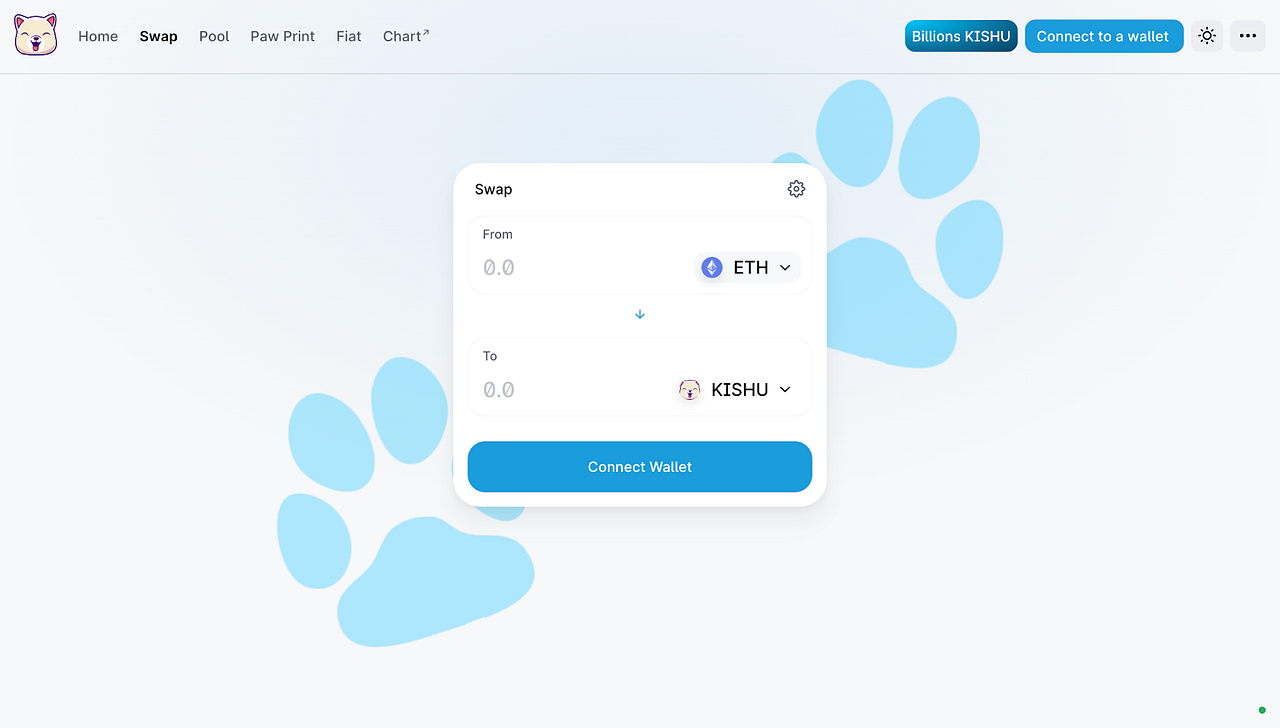

Kishu Inu has customized their UI and UX to the fullest. If you take a peek at what Kishu Inu DEX’s trading interface looks like, you will not see any connection to Rubic’s design: Rubic’s SDK UI entirely fits the platform’s native design and concept.

With simple architecture, Rubic’s SDK allows customizing the UX as well. What path can users take on Kishu Inu?

- The user chooses a “From” token.

2. Next, the user chooses a token that they want to purchase. For user convenience, $KISHU is a default “To” token, but you can change it to other assets as well.

3. Then, the number of tokens needs to be typed in. The algorithm will automatically show the final amount in other tokens that the user will receive.

4. The user clicks “Swap” and approves the transaction on MetaMask.

5. The swap is done!

Rubic’s SDK allows for massive customization of a project’s UX. In fact, projects can build the UX on their website with Rubic’s SDK however they wish.

Kishu Inu about the integration of Rubic’s SDK:

“Driven by our fundamental values, current market conditions, and recent events — we are proud to announce that in collaboration with Rubic and their masterminds behind the technology, we have revamped one of our oldest products, our Kishu Swap.

The fully new Kishu Swap X is our way of saying — we are here for the community’s convenience, safety, and pleasure in participating in the crypto space — and that is exactly our future goal.”

You can read more about Kishu Inu Swap X here.

Rubic’s Cross-Chain Solutions: A Gateway to Blockchain Interoperability for DEXs

At Rubic, it is our goal to assist other projects in opening new horizons in the cross-chain Web3 era. Our technologies are not limited just to DEXs, and can be applied to a launchpad, Web3 game, wallet, and more.

Rubic’s SDK is a way to interact with more than 220 DEXs and bridges while performing on-chain and cross-chain swaps in the most user-friendly and secure way. Blockchain technology is on the verge of becoming interoperable and omnichain, and we, Rubicans, want to make sure the world gets to experience them!

Rubic Cross-Chain Tools are built on the basis of Rubic’s Cross-Chain frontend, and all the details on integration can be found in Rubic’s documentation.

- Read ‘SDK Integration’ or ‘Widget Overview’ to kickstart your journey.

- Join the official Discord server.

- Follow our Telegram & Twitter to stay up-to-date.

Try on-chain & cross-chain swaps today, at app.rubic.exchange.

Contact one of our Business Developers for more details!

Our social media channels:

Twitter | TikTok | Telegram | Medium

Discord | YouTube | Facebook | Reddit