What Is USDT (Tether) and How Does It Work?

TL;DR

- USDT Meaning: USD Tether (USDT) is a stablecoin anchored to the value of the US dollar. It was created in 2014 and originally issued on the Omni layer on top of the Bitcoin blockchain.

- How It Works: According to the company, every USDT should be fully backed by its reserves, which include traditional currency, cash equivalents and may also include other assets and receivables from loans made by Tether to third parties (including affiliated entities).

- Key Benefits: USDT trading is available on most large cryptocurrency exchanges and has allowed users to easily arbitrage prices across trading venues globally.

Tether’s USDT has transformed how we handle digital money, making it easier to trade, store, and move value in cryptocurrency.

Unlike Bitcoin or Ethereum, whose prices can swing dramatically within hours, the USDT currency aims to keep its value constant. Tether’s stablecoin acts as a digital version of the US dollar that can move quickly across different blockchain networks.

In this deep dive, we’ll uncover the meaning of USDT (Tether) and examine its impact on the crypto market—delving into how it works, the mechanics behind its stability, what makes Tether unique, and the advantages and risks it presents.

USDT Meaning Explained: What Is USDT (Tether)?

Tether (USDT) is a “stablecoin” pegged to the value of the United States dollar. USDT maintains its value through a one-on-one backing system, where each USDT token is theoretically backed by an equivalent amount of dollars held in reserves.

By staying at $1 USD, USDT gives people a reliable way to store and exchange value in the crypto world.

USDT’s primary goal is to merge the stability of traditional currency with the efficiency of digital assets. It has a unique usefulness during periods of market turbulence, acting as a safe haven for traders.

When other cryptocurrencies experience extreme price swings, users often move their funds into USDT, making the stablecoin an essential tool for managing risk and conducting trades.

<H3> USDT (Tether) Overview

| Tether Stats | Details |

|---|---|

| Market Cap | $134.67B – Reflects the value that the market places on Tether |

| Market Cap Rank | #4 – Currently ranks fourth among all cryptocurrency assets |

| 24H Trading Volume | $294.03B – Represents the total volume of USDT traded in the past 24 hours, indicating liquidity |

| Circulating Supply | 134.66B – The total amount of USDT available in the market |

| Current Price of Tether | $1.00 – Each USDT is pegged to maintain a value of 1 USD |

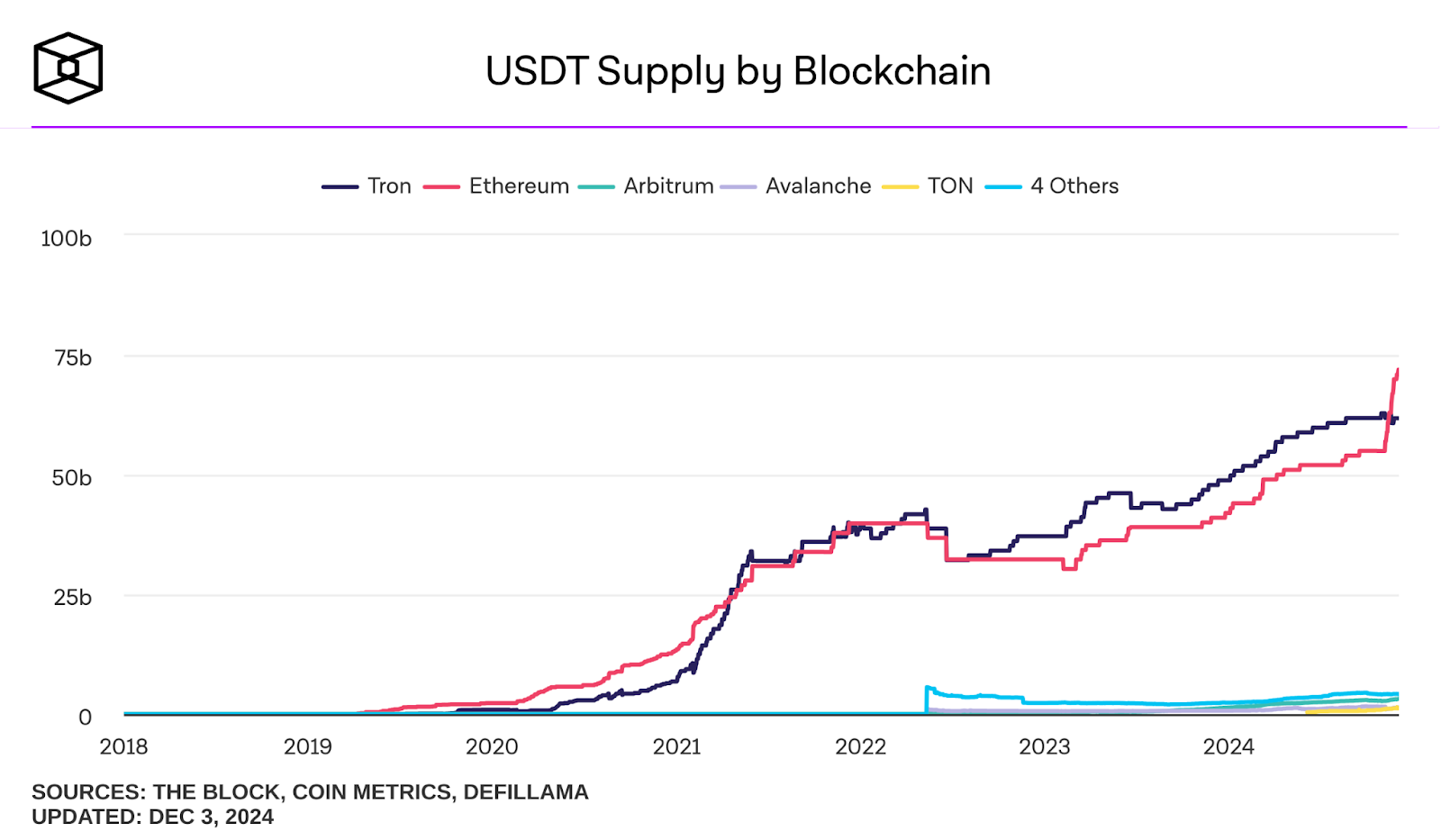

The USDT stablecoin has experienced significant growth across various blockchain networks, particularly on Ethereum Layer 2 chains: Optimism, Arbitrum, and Polygon, as well as Avalanche and Solana. USDT launched on The Open Network (TON) and Celo blockchains in early 2024, leading to an explosive increase in user adoption, with TON alone adding 3.3 million USDT users within six months.

USDT trading works on the principles of transparency and trust. Each USDT token should be backed by actual reserves of traditional currency and similar assets.

USDT lets you quickly switch between different cryptocurrencies without converting to regular money. This means you should be able to exchange USDT for real US dollars at any time, though this usually happens through crypto exchanges.

Traders also often use the USDT market cap as a key indicator of overall market sentiment and potential investment opportunities. When Tether’s market cap is high, it signals that many users are holding USDT, ready to invest when the time feels right.

History of Tether

Tether (USDT) was originally launched as “Realcoin” on October 6, 2014, by Brock Pierce, Reeve Collins, and Craig Sellars, who were part of the Omni Foundation. The Omni Protocol allowed Tether to operate on Bitcoin’s blockchain, enabling users to create and trade digital assets directly. By November 20, 2014, the team decided to rebrand Realcoin to “Tether” (USDT).

Tether’s journey since its inception has been filled with rapid growth and notable controversies. In January 2015, Bitfinex began trading USDT on its platform, which led to increasing transaction volumes, particularly involving USD transactions routed through Taiwanese banks and, eventually, Wells Fargo. This arrangement worked smoothly until 2017, when US banks blocked Tether’s international transfers, triggering major disruptions.

In April 2019, the New York State Attorney General (NYAG) revealed conflicting transactions between Bitfinex and Tether in an alleged attempt to cover the loss. By 2021, Bitfinex claimed that it had repaid the loan; however, the NYAG found that Bitfinex and Tether made additional false statements to conceal the losses, ultimately leading to financial arrangements between the two to cover the losses.

This lack of transparency, combined with high-profile leaks like the Paradise Papers, led to intense speculation about whether Tether had sufficient reserves backing its tokens.

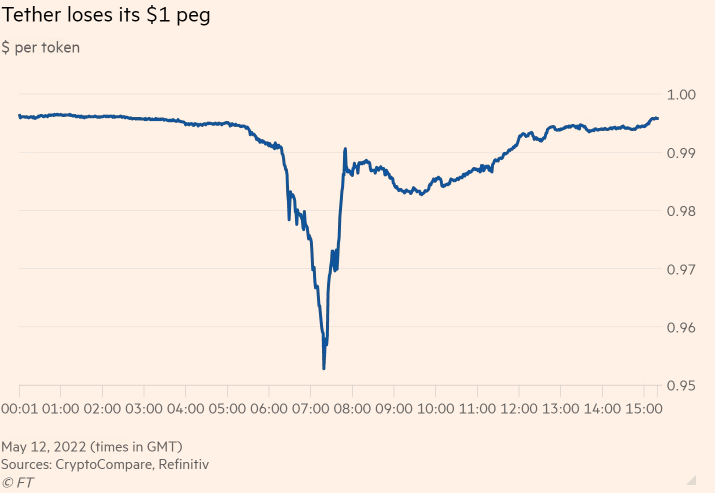

If Tether were to face liquidity issues, the value of USDT could be affected, impacting its effectiveness as a stable payment method. In May 2022, the USDT currency tumbled as low as 0.95 cents in European trading, far below the $1 peg that it seeks to maintain as it faced an intense bout of selling pressure. Its price later recovered, but the rare slip-up, days after the failure of smaller rival TerraUSD, sent Bitcoin sinking to its lowest level since late 2020.

Tether loses its $1 peg in May 2022. Source: Financial Times

Despite these challenges, Tether’s market presence continued to grow, and demand for stablecoins has increased significantly this year, in part, as a result of interest rates being raised to tamp down an overheated economy.

How Does USDT Work?

USDT transactions work through smart contracts that help keep the token’s value stable. As a stablecoin, USDT uses a combination of pegging, backing, and blockchain technology to maintain its value at $1 USD.

How is Currency Pegged and How Does USDT Maintain Its Peg?

| USDT Pegging Mechanism | Description |

|---|---|

| Backing Reserves | Each USDT is backed by an equivalent reserve amount (USD or cash equivalents). |

| Supply Adjustment | New tokens are created or removed based on market demand to maintain stability. |

| Arbitrage Trading | Traders exploit price differences to help keep USDT close to its $1 target. |

Pegging is the process of fixing the value of one currency to another, which means that each USDT stablecoin is designed to be worth one US dollar. This happens through several strategies of market forces and careful management of reserves, such as:

- Backing with Reserves: Tether claims that for every USDT issued, there is an equivalent amount held in reserves, primarily in U.S. dollars or cash equivalents. This backing provides a safety net that reassures users about the token’s value.

- Market Forces: The supply of USDT is adjusted based on demand. When more people want to buy USDT, Tether can issue new tokens. Conversely, if demand decreases, tokens can be redeemed and removed from circulation, helping maintain the price around $1.

- Arbitrage Opportunities: If USDT’s price rises above $1, traders can buy it at a lower price and sell it for a profit on exchanges where it’s priced higher. If it drops below $1, they can purchase it at a discount and redeem it for $1, thus incentivizing price corrections. When more people want USDT, new tokens are created; when demand drops, tokens are removed to keep the price stable.

Key Features & Advantages of USDT

Tether’s USDT stablecoin is essential in crypto exchanges, loans, and yield farming. Here’s a breakdown of its key features and advantages, particularly for USDT trading:

Liquidity

As the most traded stablecoin, the Tether cryptocurrency offers incredible market depth and accessibility. This high liquidity means you can trade large amounts without causing big price changes—leading to smaller spreads (the difference between buy and sell prices) and reducing the risk of sudden, unpredictable price swings.

Another advantage of Tether is its widespread adoption. Tether is supported by numerous cryptocurrency exchanges and platforms, making it easy for users to buy, sell, and trade Tether for other digital assets.

The more people use USDT, the more valuable it becomes—a classic example of the network effect at work, just like with other cryptocurrencies. You’ll find USDT trading pairs for almost every major cryptocurrency on exchanges.

Price Stability

As a stablecoin, Tether keeps its value pegged to the US dollar, allowing investors to avoid the wild price swings of most cryptocurrencies.

But it’s not just about stability. Unlike traditional banking, where international transfers can take days and come with hefty fees, Tether moves fast. You can transfer funds across borders in minutes (though this can vary depending on network conditions and the amount being transferred), making it a practical option for anyone needing quick, efficient access to capital without the usual banking bottlenecks.

Reserve Backing

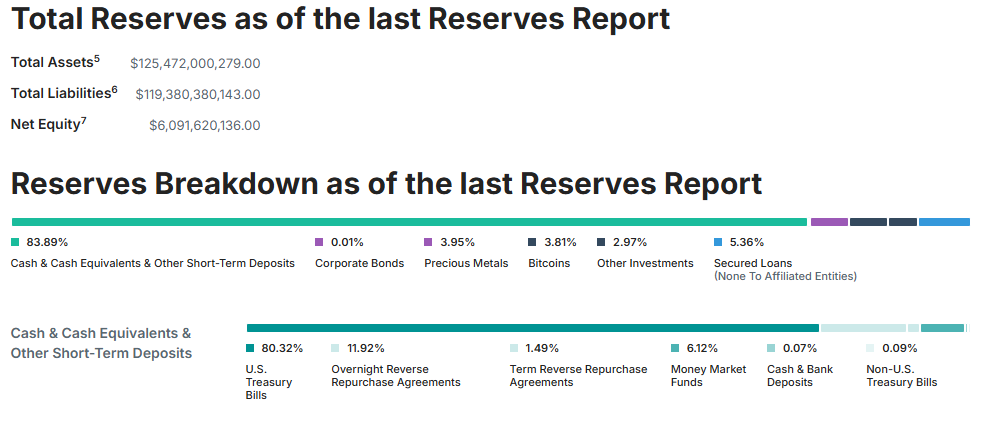

Tether provides financial statements that show what assets they hold as backing collateral. Their accounting provider, BDO, did the most recent report in September 2024. Source: Tether

Tether claims that every USDT in circulation is fully backed by its reserves, ensuring that each token can be redeemed for its equivalent in fiat currency. These reserves consist of traditional currency and cash equivalents, along with other assets and receivables from loans Tether may have extended to third parties.

Tether provides regular attestations as part of their proof of reserves to demonstrate that the amount of assets held matches or exceeds the number of Tether tokens issued. While not a full audit, Tether’s proof of reserves aims to show that they have enough assets to cover every USDT issued, maintaining stability and reliability for users.

Despite Tether’s proof of reserves, there has been ongoing debate and skepticism within the crypto community regarding its reserve practices.

Some have called for more rigorous, independent audits to verify the exact composition and safety of these reserves. This skepticism stems from Tether’s history of controversies, but the company continues to issue reports and maintain that its reserves are sufficient.

Supply of Tether

The supply of Tether (USDT) is tightly controlled to ensure that each token is fully backed by fiat collateral.

Only Tether can mint new tokens—no one else can create USDT. This keeps the issuance centralized and maintains the promise that each USDT is backed by equivalent reserves.

To get Tether tokens directly from the source, buyers must register and complete Tether’s Know-Your-Customer (KYC) verification process. But once those tokens are in circulation, they can be sold, transferred, or used like any other cryptocurrency without new holders needing to go through Tether’s verification.

When redeeming USDT into fiat currency, holders can sell through a crypto exchange that supports cashing out or redeem directly through Tether. If redeemed through Tether, those tokens might be burned to decrease the total supply, or they might be held in Tether’s treasury for future issuance if demand picks up.

Blockchains Supported

Tether has expanded across multiple blockchain networks, each with its contract address and token standard. To determine which network your USDT is on, you can simply check its contract address.

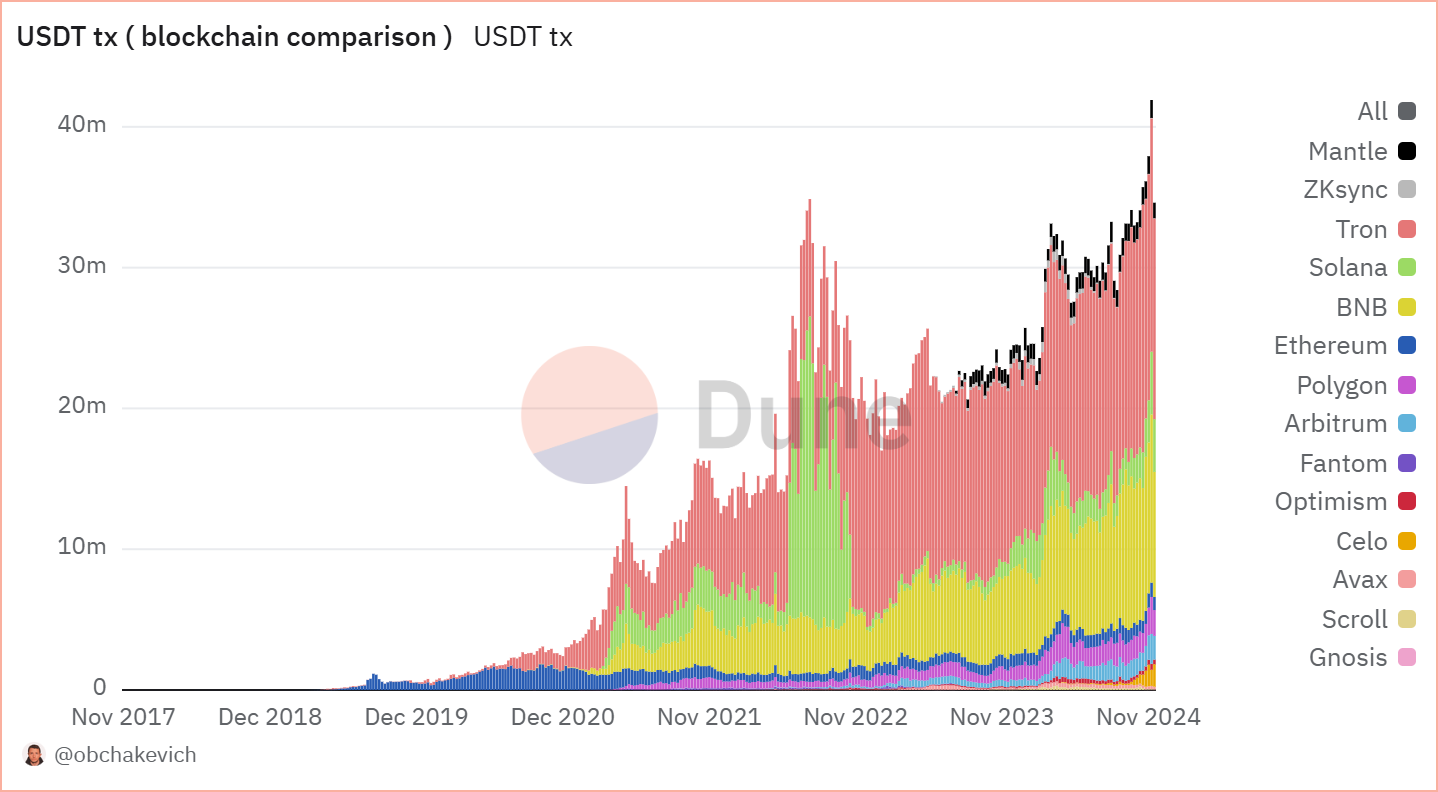

TRON is now the leading network for USDT transactions, reflecting its growing popularity and demand as a payment method. Its platform offers scalability and cost efficiency, attracting more businesses and users to its services. According to the data from Dune Analytics, TRC-20 accounts for over 46% of all USDT transactions; USDT TRC-20 is a version of Tether that operates on the TRON blockchain.

Total USDT transactions by volume across all blockchains. Source: Dune Analytics

Among other popular USDT networks are Ethereum, BNB, Arbitrum, Avalanche, TON, Solana, and Polygon. In July 2024, Tether announced that it will no longer be obligated to accept redemption of USDT or EURT on Omni, Kusama, SLP, EOS, and Algorand starting September 2025. Tether will also freeze all remaining USDT and EURT on Omni, Kusama, SLP, EOS, and Algorand.

Tether’s broad compatibility and adoption allow users to choose the network that best fits their needs, whether it’s low fees, faster transactions, or integration with specific decentralized applications (dApps).

Transparency

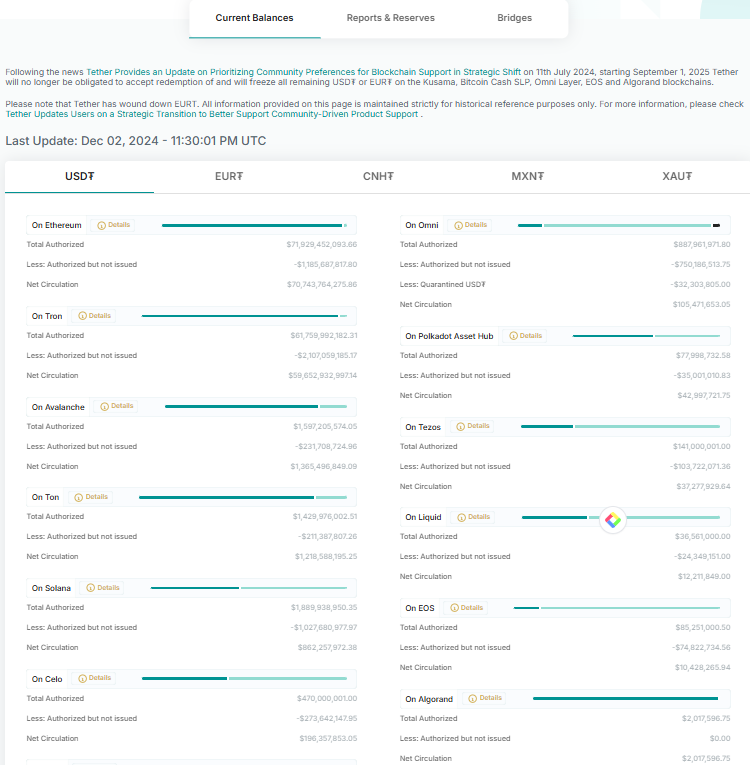

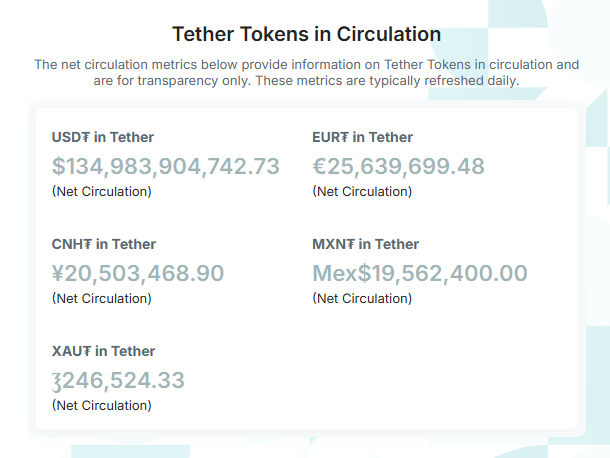

Tether typically publishes daily updates on the number of tokens in circulation, offering transparency on the balances of its stablecoins across different blockchains. This includes disclosing the total amount of USDT authorized for issuance, as shown below.

Tether’s current balances as of the latest Reserves Report. Source: Tether

| Terms | Description |

|---|---|

| Authorized but Not Issued | Tokens reserved by Tether but not yet released. These tokens are only partially backed by fiat since they have yet to be sold. This reserve acts as a buffer for new buyers. |

| Liabilities | The total number of USDT coins held by investors and traders. Tether must maintain a 1:1 collateral backing for these tokens to ensure stability. |

| Total Assets | The value of assets Tether holds as collateral for issued tokens. This value should at least match or exceed the liabilities. |

| Shareholder Capital Cushion | The excess of total assets over total liabilities. This cushion provides an extra safety net for stability and risk management. |

Tether Use Cases

In an upward-trending market, USDT acts as a bridge through which users can gain exposure to other tokens in the ecosystem as a source of liquidity essential to facilitate on-chain and trading activity. In market downtrends or during periods of volatility, the USDT stablecoin serves as a store of value or means of savings, enabling users to store wealth or earn yield from on-chain and off-chain sources.

Beyond its use as a medium of exchange and liquidity, USDT is also fundamental for non-trading purposes, such as facilitating transactions and settling value on-chain.

In emerging markets—like Argentina, Turkey, Brazil, India, and Vietnam—USDT payments on the TRON blockchain are particularly popular, as an alternative to the U.S. dollar rather than by demand for cryptocurrency trading.

Here’s a breakdown of Tether’s key use cases:

- Trading and Exchange: Acts as the primary currency pair for crypto trading, offering stability and liquidity.

- Sending Money Abroad: Facilitates quick, affordable international transfers without currency exchange complexities or high bank fees.

- DeFi Activities: Enables lending, borrowing, and yield farming, helping users earn rewards while holding a stable asset.

- Online Shopping: Accepted as a payment method by many e-commerce platforms, including Travala, Expedia, Shopify, and Epic Games Store.

- Payroll and Vendor Payments: Allows businesses to pay employees and vendors in digital currency, streamlining transactions and reducing reliance on traditional fiat currencies.

However, there are risks involved. While USDT can offer some privacy compared to traditional payment methods (since it does not require sharing sensitive financial information), transactions are recorded on a public blockchain and can be traced back to users, raising concerns about privacy depending on how wallets are managed.

Additionally, payments in USDT are irreversible, which means if you send funds to the wrong address or fall victim to fraud, there’s no way to retrieve those funds.

USDT Drawbacks and Controversies

Much like most cryptocurrencies, several issues have raised eyebrows about the world’s biggest stablecoin, including:

Market Manipulation

The relationship between stablecoin supply and the price of Bitcoin has been the subject of much debate, suggesting that Tether has been used strategically to boost Bitcoin’s price during market downturns.

A 2019 study found that new Tether issuances often align with Bitcoin price increases, particularly when the market is struggling. This pattern has led to speculation that Tether might be used to stabilize or even artificially inflate Bitcoin prices during downturns. Essentially, the idea is that minting new USDT and injecting it into the market could give an impression of increased demand, thereby nudging Bitcoin prices upward.

In 2019, a class action lawsuit claimed that Tether and Bitfinex manipulated the crypto market by printing large amounts of USDT whenever Bitcoin prices dropped. The argument was that entities connected to Bitfinex could inject USDT to inflate Bitcoin’s price and then convert the Bitcoin back to USDT to bolster their reserves.

Bitfinex has denied these allegations outright, maintaining that its operations are fully transparent and compliant with regulations. They argue that Tether issuance is not, and cannot be, used to prop up Bitcoin or any other cryptocurrency.

Tether’s Proof of Reserves

Tether tokens in circulation. Source: Tether

The stability of USDT relies on Tether’s reserves, and ongoing questions about the transparency and adequacy of those reserves introduce potential uncertainties.

Though Tether previously claimed that every coin was backed entirely by U.S. dollars, it reversed that assurance in 2019 and now states that its reserves contain cash, cryptocurrency, Treasury bills, money market funds, and other assets.

In 2021, an investigation by the office of the New York Attorney General (OAG) discovered that during parts of 2017, Tether didn’t always have the reserves they claimed to back their tokens one-to-one.

Tether released an attestation for Q3/2024. Source: Tether

In October 2024, Tether reported that its nine-month profit total for this year had hit $7.7 billion, up from $5.2 billion during the first half of 2024. Its Q3 2024 Attestation states that Tether’s reserves comprise over $105 billion in cash and cash equivalents.

Paolo Ardoino, CEO of Tether, recently revealed that Tether holds about $100 billion in US Treasuries, more than 82,000 Bitcoin BTC valued at roughly $5.5 billion using current market prices, and 48 tons of gold to back its USDT stablecoin—adding that the company has also increased its reserve buffer to over $6 billion as part of its commitment to “responsible risk management.”

Tether’s latest Consolidated Financial Figures and Reserves Report (CFFRR) reaffirms that the value of Tether’s reserves exceeds its liabilities by about $6.09 billion. This surplus acts as a buffer, indicating that Tether has more assets than the total value of tokens it has issued, theoretically making it capable of covering all issued USDT with an additional cushion.

Tether’s proof of reserves is meant to boost confidence that Tether can fulfill redemptions and manage risks effectively. However, Tether has never had a definitive audit of its $105 billion in reserves and relies on quarterly attestations from BDO Italia, which does not constitute formal audits and merely confirm the existence of certain assets without any serious due diligence.

Notably, Tether has not undergone a full audit by any of the Big Four accounting firms—Deloitte, PwC, EY, or KPMG. According to Ardoino, these firms have been reluctant to engage with Tether due to potential reputational risks.

Some may question whether these buffers are sufficient since any mention of investments can raise concerns over whether reserves are adequately safeguarded.

Because there is no regulation of the reserve assets, it is up to Tether how to invest their reserves. We also do not know how liquid or redeemable these assets are should Tether need to cash to honor its liabilities.

By comparison, its closest competitor, USDC, run by Circle Financial, publishes specific Treasury securities, CUSIPs, and maturity dates that support its $38 billion digital dollar.

Regulatory Scrutiny

Tether continues to grapple with regulatory scrutiny, a recurring theme in its journey as crypto’s leading stablecoin.

Here’s the latest breakdown of the USDT stablecoin’s growing regulatory and legal challenges:

- Pending Stablecoin Legislation: The U.S. is gearing up to introduce new federal regulations for stablecoins, potentially starting in 2025. These regulations aim to replace the current patchwork of state-level rules with a uniform federal framework. If enacted, Tether will likely need to meet stricter compliance standards, especially given its history of regulatory issues, including a ban from operating in New York since 2021 due to concerns around its reserve practices and transparency. However, the regulatory landscape for stablecoins has been anything but stable.

- Implementation of MiCA: In November 2024, Tether announced that it would discontinue support for EURT, advising customers to redeem their Euro stablecoin holdings within one year. This decision came as EURT saw limited adoption compared to USDT. It also coincides with the implementation of the European Union’s Markets in Crypto-Assets (MiCA) regulation, set to take full effect at the end of December 2024, requiring stablecoin issuers to hold at least 60% of reserve assets in European banks. With this in mind, Tether is shifting its focus to new projects, such as partnering with Quantoz Payments to launch MiCAR-compliant stablecoins EURQ and USDQ, using its Hadron technology platform.

- Limited Public Oversight: Unlike traditional financial institutions, Tether operates with minimal regulatory oversight. There are no rules governing how Tether manages the reserves backing its stablecoins, and there is no government guarantee in case of a loss, as would be the case with a bank deposit.

- Use in Illicit Activities: A January 2024 report by the UN Office on Drugs and Crime (UNODC) found that USDT on the TRON blockchain has become a preferred choice for crypto money launderers in Southeast Asia. Tether’s recent highlight of its proof of reserves came amid the uncertainty caused by a Wall Street Journal article in October 2024, which claimed that US authorities were probing the firm for allegedly violating anti-money laundering laws and US sanctions, including connections with Hamas and Russian arms dealers. Tether has since issued a strong statement, denying all allegations and calling the claims speculative.

A timeline of US government actions involving Tether. Source: Protos

Centralization

The value of USDT, like any currency—decentralized or centralized—relies heavily on public trust in its stability and long-term viability. Unlike many cryptocurrencies that are managed in a decentralized way, USDT is controlled entirely by Tether Limited.

This centralization introduces several key risks:

- A single point where things could go wrong in managing reserves.

- Decisions regarding USDT are made solely by Tether Limited, with no community input.

- Tether still depends on relationships with traditional banks to manage its reserves. Any disruptions in these relationships could threaten USDT’s ability to maintain its peg.

- Centralized control also makes USDT vulnerable to government actions, such as asset freezes or regulatory crackdowns.

Additionally, USDT’s ability to freeze personal assets and restrict access has raised concerns about how much control users truly have over their assets—adding to the debate over the risks of a centralized stablecoin.

Tether’s Impact on the Crypto Market

Tether is crucial for providing liquidity in the cryptocurrency market. It acts as a bridge between fiat currencies and digital assets, allowing traders to quickly convert their holdings into something stable during times of volatility.

USDT Market Position

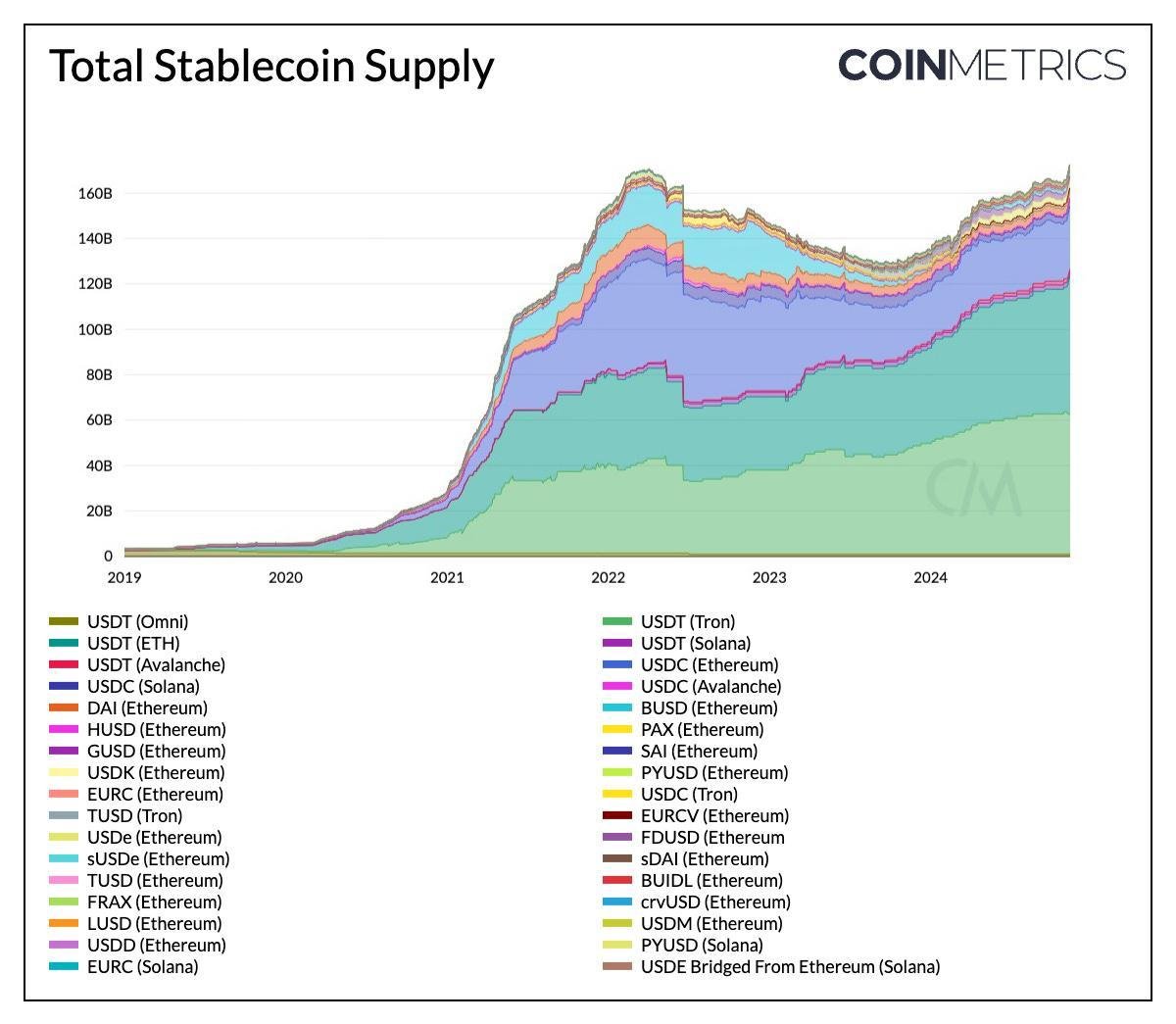

The chart shows a timeline of the total supply of stablecoins issued. Source: Coin Metrics Market Data Feed

With the crypto market surging post-election and over $200 billion in stablecoins issued, USDT has solidified its position as the most popular stablecoin of 2024, boasting a market cap of over $135 billion and a total supply of $138 billion—capturing 69% of market share. Circle’s USDC follows in second place, with $36 billion in total supply and a 19% market share.

This influx suggests a bullish phase with growing liquidity as users position themselves to capitalize on appreciating prices and emerging opportunities in the on-chain ecosystem.

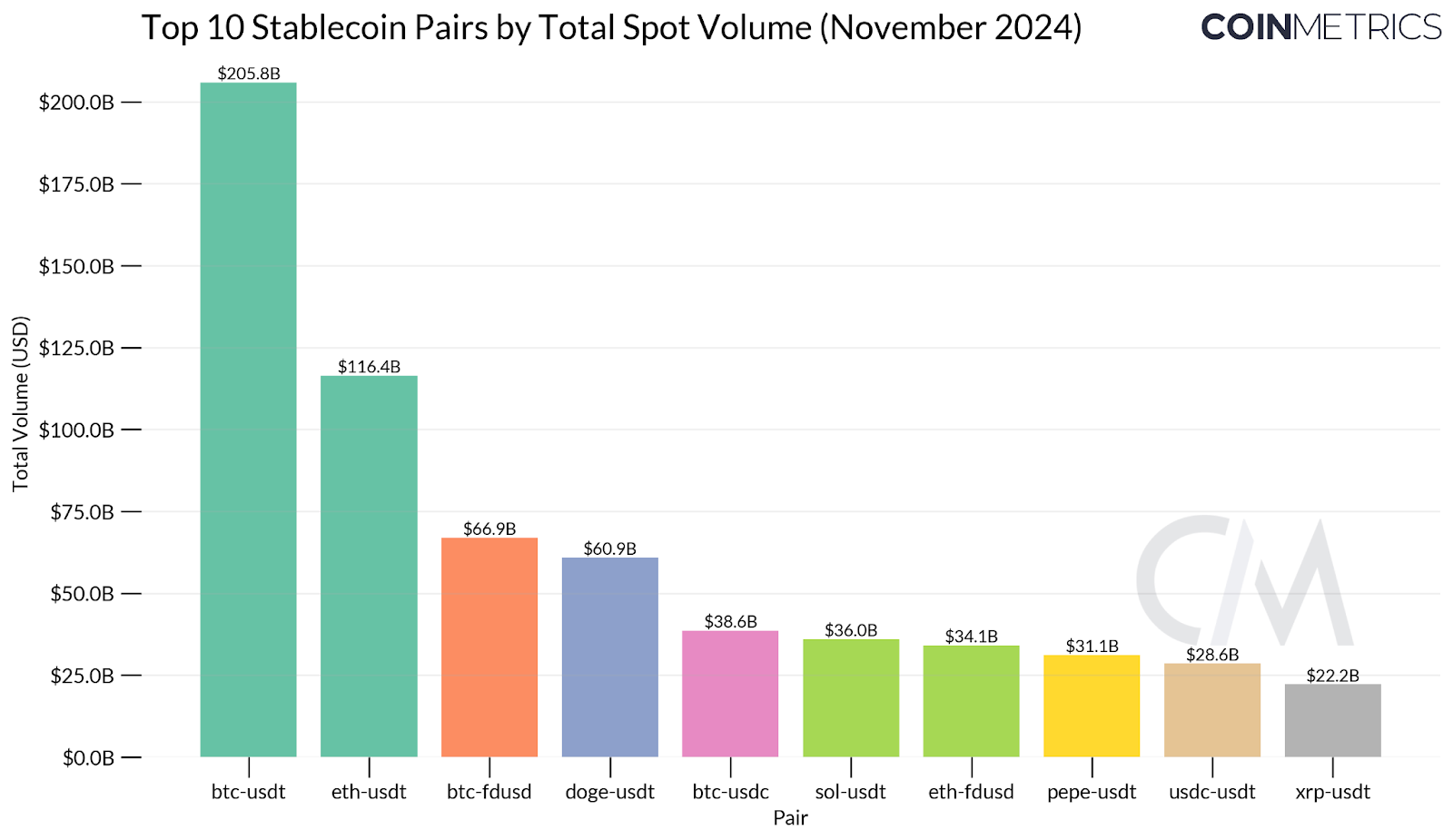

The chart shows stablecoin-denominated trading volumes across exchanges crossed $120B as trading activity increased.

Of this total, Tether’s USDT accounted for ~80% or $95B in spot volumes recorded on November 12th. Source: Coin Metrics Market Data Feed

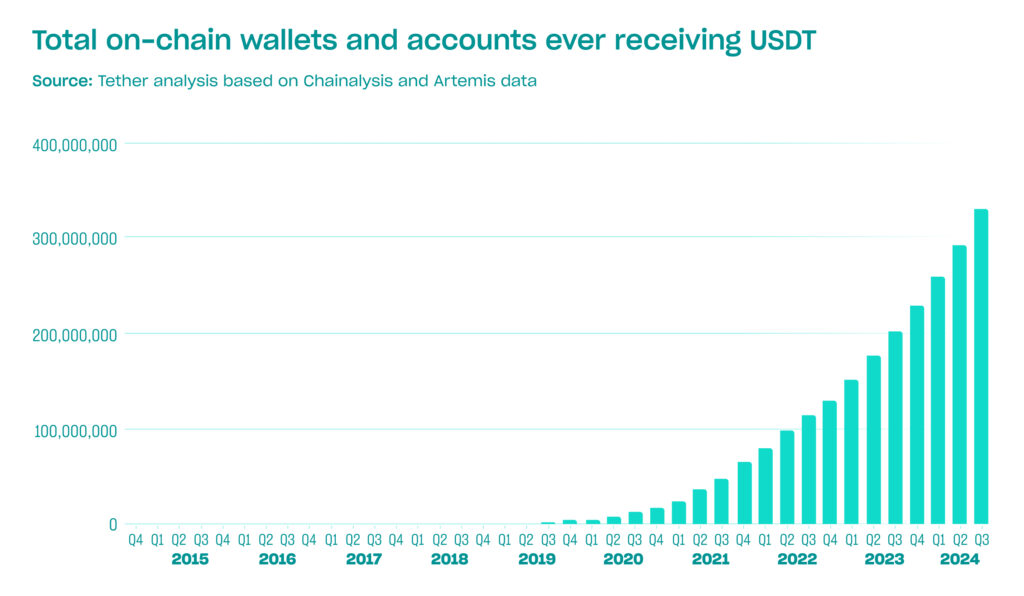

The chart shows 330 million on-chain wallets and accounts receiving USDT by the end of Q3 2024. Source: Tether

Issued across multiple blockchains like Ethereum and Tron, Tether’s fast transactions and growing adoption have led to 330 million wallets utilizing USDT, while the daily trading volume reached over $290 billion in November 2024.

The chart shows USDT supply across major blockchain networks. Source: The Block

While there are 135 billion tethers in circulation, the bulk are on the Tron and Ethereum networks. Currently, Tether’s transparency page reports over 131 billion tether (USDT) are hosted across both blockchains, with Ethereum holding 6.47 million unique USDT addresses while on Tron, it’s around 57 million.

Binance, the world’s largest crypto exchange by trade volume, is a major player, holding a significant amount of Tron-based tethers. The “Tether Treasury” wallet ranks fifth among the top Tron-based USDT holders, owning just over 655 million tokens. Right behind that, Binance has the sixth-largest wallet on Tron.

On Ethereum, Binance is even more dominant—it holds 5.6 billion Ethereum-native USDT, making it the largest holder with 10.78% of the supply. Next is Arbitrum One, holding 4.6% of the supply, followed by another Binance wallet with 1.82 billion USDT (3.5%). Together, the top 100 holders control 54.55% of the Ethereum-based USDT supply.

The USDT landscape shows a network of big players holding massive portions across different blockchains. This concentration of USDT among just a few key players—especially Binance—highlights how much influence these major entities have in the stablecoin market.

<H3> Tether and Bitcoin

The chart shows BTC/USDT (Bitcoin vs Tether) price performance. Source: TradingView

The debate over Tether’s (USDT) influence on Bitcoin prices has been around for a while—especially when it comes to whether Tether is driven by actual demand or is being printed to artificially pump the market.

Studies investigating the relationship between Tether and Bitcoin found that large Tether purchases often come right after market downturns and tend to push Bitcoin prices up, particularly back in 2017. This pattern, often linked to one main entity, suggests that Tether might not always be acting based on real demand but rather as a way to boost the market.

While there is a legitimate demand for USDT, the data suggests that this isn’t what’s driving the majority of Tether’s flow. Past research has also shown that macroeconomic factors, stock markets, and other commodities don’t explain crypto price movements well, but Tether seems to have a real impact on Bitcoin’s price. This supports the idea that investors may benefit from these inflated bubbles, capitalizing on market movements potentially influenced by Tether.

That said, some think big players mint USDT ahead of buying crypto, which could explain some of the correlation.

Another line of thought is that Tether mints USDT mostly to keep up with growing demand and trading volumes, not necessarily to manipulate the market. This approach isn’t fundamentally different from practices like margin trading or trading futures—both of which involve increasing liquidity and leverage without necessarily holding underlying assets.

Plus, the market today is far more mature compared to 2017. With higher liquidity, more institutional investors, and better opportunities to short Bitcoin, the influence of Tether today looks different.

<H3> What Makes Tether Unique?

Despite the collapse of high-profile crypto projects like Celsius, Luna, and FTX, Tether has managed to maintain its stability and relevance in the crypto space for several key reasons:

- Trust as a Self-Fulfilling Prophecy: The ongoing trust in Tether has kept it afloat even when others have faltered. As long as users continue to believe in USDT’s stability, it remains effective, creating a feedback loop of confidence.

- Balance of Centralized and Decentralized Features: Tether combines centralized control with transparent governance. It has the power to freeze assets linked to illicit activities—a centralized function—but this is governed by transparent smart contracts, not arbitrary decisions. This blend allows for compliance and security while maintaining user trust. Smart contracts help ensure any freezing of assets is conducted under predefined conditions, adding a level of transparency that contrasts with traditional financial systems where changes can be unpredictable and opaque.

- Facilitating Transactions: As the dominant stablecoin, USDT facilitates trading on numerous exchanges, allowing investors to enter or exit positions quickly.

- Widespread Adoption: USDT’s acceptance across most major exchanges makes it easy for traders to move in and out of positions without converting back to fiat. Its utility as a stable intermediary gives it an edge over other options in the market.

- Shifting Reserves: Facing increased scrutiny, Tether has adjusted its reserve strategy, shifting to safer assets like U.S. Treasury bills. This move has positioned Tether among the top holders of such securities, reinforcing its claim of being backed by stable assets.

Tether’s stability is closely tied to the broader market sentiment and Bitcoin’s performance. However, as regulatory scrutiny continues to increase, Tether’s ability to continue providing security and liquidity will depend on how well it can navigate the uncertainties ahead.

How to Buy USDT (Tether)

Tether (USDT) is designed to maintain a 1:1 peg with the U.S. dollar, theoretically allowing users to redeem each USDT for one dollar directly through Tether Limited. However, this direct redemption process is primarily tailored for large-scale transactions due to the minimum redemption amount set at 100,000 USD equivalent (accompanied by a fee of 0.1% or $1,000, whichever is greater).

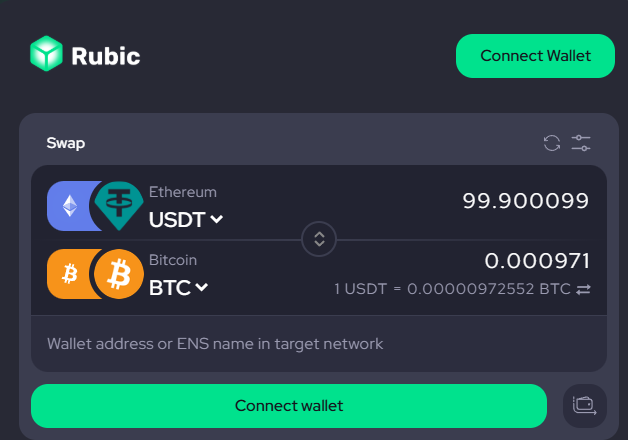

For everyday users, buying USDT is best done through cryptocurrency exchanges, crypto on-ramp platforms, or digital trading platforms. Aside from traditional exchanges like Kraken, Binance, and Coinbase, Rubic Exchange stands out as a convenient platform for buying USDT.

As a cross-chain bridge and DEX aggregator, Rubic Exchange allows users to easily swap USDT for BTC and other tokens, offering liquidity and flexibility. Rubic’s Smart Routing system for cross-chain swaps ensures users get the best provider to complete swaps at the optimal price.

To exchange USDT on Rubic, start by exploring the available trading pairs and selecting the desired token and network for your swap:

- Choose the source and target networks, and select USDT and the token you wish to exchange.

- Specify the amount of USDT you want to swap.

- Connect your crypto wallet to Rubic.

- Click the swap button to finalize your trade in just one click.

Since Tether tokens are currently available using different blockchains, users need to be careful to confirm they are using the correct version for that blockchain or transport protocol. Each version of USDT—whether it’s on Ethereum (ERC-20), TRON (TRC-20), Binance Smart Chain (BEP-20), or others—has a unique contract address and operates on its respective network. Sending USDT to an incompatible address or selecting the wrong protocol can result in permanent loss of funds.

Final Thoughts on Tether (USDT)

If Terra’s UST collapse taught us anything, it’s that stablecoins aren’t invincible. The fact that stablecoins like Tether need to exist at all points to the glaring weakness in Bitcoin and other cryptocurrencies. Over a decade in, Bitcoin remains wildly unpredictable, and Tether’s USDT was invented as a solution to bridge the gap but comes with risks of its own.

As fiat-collateralized stablecoins grow in market cap, third-party audits proving “proof of reserves” are becoming critical. For all the hype about bypassing banks, crypto still needs oversight and regulation to maintain the trust and stability it promises.

Tether’s lack of a full audit leaves lingering doubts about its reserves, and events like the FTX collapse and the crackdown on Paxos-issued BUSD have only increased regulatory pressure on the stablecoin market.

Legal frameworks like MiCA, requiring 60% of reserves to be held in regulated banks, add traditional finance risks like exposure to bank failures or frozen funds. Liquid collateral valuations can also shift, creating unseen risks—even for seasoned investors. Shady exchanges could also freeze USDT withdrawals if something goes wrong, and while most traditional market makers are aware of these risks, smaller investors may not be as prepared.

A “bank run” scenario, where redemptions outpace reserves, could escalate quickly, leading to depegging and market contagion. Binance’s temporary pause on USDC withdrawals in late 2022 serves as a reminder of this vulnerability.

Whether Tether can weather such stress depends on how it navigates growing regulatory pressure and market volatility.

Interestingly, Tether seems less focused on pleasing its critics and more on supporting underbanked populations in emerging markets like Turkey, Venezuela, and Argentina. By doubling down on its role as a lifeline for people needing access to stable currencies, Tether positions itself as a financial tool for those excluded from traditional systems rather than a competitor to institutional players like JPMorgan.

Ultimately, stablecoins like Tether promise stability in a volatile crypto market but remain exposed to reserve risks, regulatory action, and depegging. The USDT stablecoin’s success depends on maintaining trust, adapting to shifting landscapes, and continuing to serve those who rely on them most.

FAQs About USDT

- Is Tether safe to use?

While USDT is widely used, it comes with risks like any financial tool. Its safety depends on things like reserve backing, following regulations, and market conditions. Do your research and only invest what you can afford to lose.

- How does Tether maintain its dollar peg?

Tether maintains its dollar peg by backing each USDT token with equivalent reserves, which include cash, cash equivalents, and other financial assets. This 1:1 backing ensures that each USDT can be redeemed for one U.S. dollar.

- Can I exchange USDT for cash?

Yes, you can exchange USDT for cash through cryptocurrency exchanges or trading platforms. Many platforms, like Binance, Coinbase, and Kraken, allow you to sell USDT and withdraw the funds in your local currency. Always check the exchange’s withdrawal options and fees before proceeding.

- What are the fees associated with using USDT?

Fees for USDT exchange vary and depend on the specific transaction. You can check the applicable fees during the exchange process.

- Is USDT regulated?

USDT operates under different rules in different countries. While it has some oversight, it’s not regulated like traditional financial products, and the rules can change.