Understanding Intent-Based Bridging and Rubic as an Intent Aggregator

DeFi users, even seasoned ones, often encounter complicated processes and multiple transactions to achieve their desired outcomes. From executing swaps on DEXs to implementing cross-chain swaps, the user experience can be fragmented and require a deep understanding of blockchain compatibility, liquidity dynamics, gas fees, and the intricacies of different protocols. Despite the shared ambition to make blockchain so intuitive that even your grandma could use it, we are still far from achieving this level of accessibility.

Intent protocols aim to abstract away these complexities, allowing you to simply declare your intent – for example, “swap 1 ETH for USDC” – and let the underlying infrastructure handle the rest in the most efficient way possible.

What Exactly Are Intent Protocols?

DeFi users, even seasoned ones, often encounter complicated processes and multiple transactions to achieve their desired outcomes. From executing swaps on DEXs to implementing cross-chain swaps, the user experience can be fragmented and require a deep understanding of blockchain compatibility, liquidity dynamics, gas fees, and the intricacies of different protocols. Despite the shared ambition to make blockchain so intuitive that even your grandma could use it, we are still far from achieving this level of accessibility.

Intent protocols aim to abstract away these complexities, allowing you to simply declare your intent – for example, “swap 1 ETH for USDC” – and let the underlying infrastructure handle the rest in the most efficient way possible.

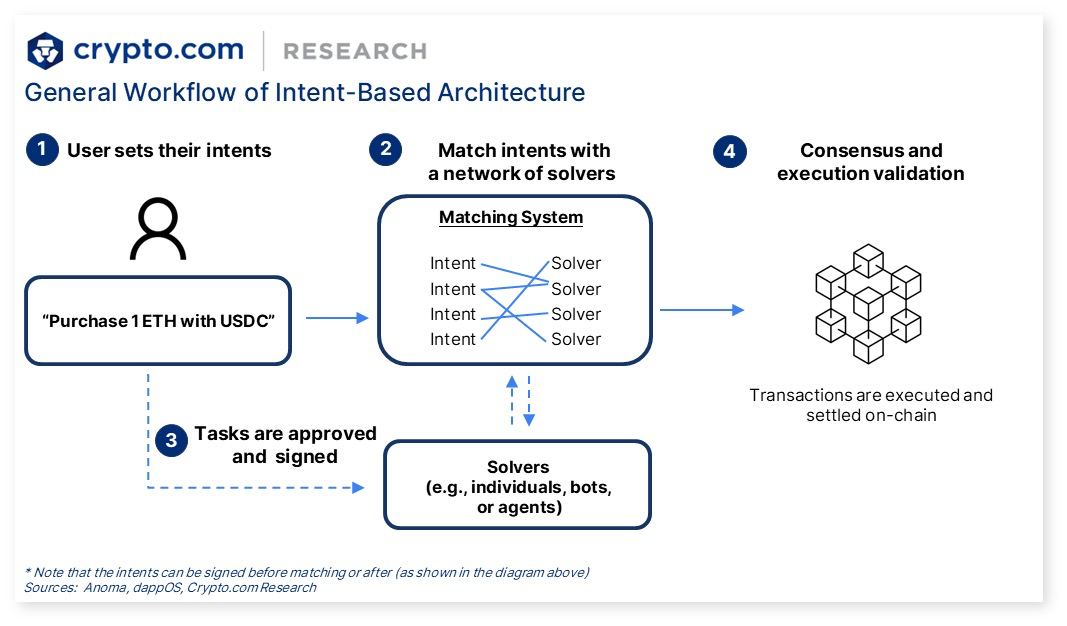

How Intent Protocols Work

Yeah, as they say, it’s all about solvers. Solvers are the backbone of this chain-abstracted, intent-based future. They play a crucial role in optimizing transactions, sourcing the best liquidity, and ensuring seamless execution for users. Everything stands on them – from efficiently routing trades across multiple networks to minimizing costs and slippage. Without solvers, the entire intent-based ecosystem wouldn’t function as smoothly, making them the driving force behind this next-gen technology:

- User Defines an Intent: The user specifies, “I want to swap 10 ETH for the best possible USDC price within 5 minutes.”

- Solvers Compete to Fulfill the Intent: A network of solvers (market makers, aggregators, or liquidity providers) analyze the request and propose the best possible execution path.

- Transaction Execution and Settlement: The most competitive solver executes the transaction, often bundling multiple on-chain operations to optimize fees and reduce slippage.

- User Receives the Best Outcome: The transaction is completed with optimal pricing, routing, and execution efficiency.

Source: https://crypto.com/en/research/intent-based-protocols-oct-2024

Key Benefits of Intent Protocols:

- Simplified User Experience: By abstracting away the technical complexities of blockchain interactions, intent protocols make DeFi more accessible to a wider range of users.

- Enhanced Efficiency: Intent protocols can optimize transaction execution by considering various factors like price, speed, and cost across different platforms. This can lead to better swap rates, lower gas fees, and faster transaction times.

- Mitigation of MEV (Miner/Maximal Extractable Value): By allowing multiple execution paths to fulfill a user’s intent, these protocols can reduce the opportunities for malicious actors to front-run or exploit transactions for profit.

- Liquidity Aggregation: Intent protocols can potentially tap into fragmented liquidity across various DEXs and blockchains, providing users with better access to trading opportunities.

- Cross-Chain Interoperability: Intents can facilitate seamless cross-chain transactions by abstracting away the complexities of bridging assets between different networks. Users could simply express the intent to move an asset from one chain to another without needing to manually manage the bridging process.

Challenges and Considerations

Well, where there’s innovation, there are always hurdles, right? While intent protocols offer significant advantages, they also introduce challenges:

- Trust in Solvers: Decentralized solver networks must be designed carefully to prevent collusion, censorship, or manipulation.

- Latency and Competition: Since solvers compete for execution, there may be delays in fulfilling intents, especially in high-volatility markets.

- Security Risks: Ensuring that solvers act honestly and that intent execution is trustless is crucial for preventing potential exploits.

Overall, intent-based protocols are emerging as the most innovative and next-generation technology for asset swapping. They streamline complex operations, reduce friction, and improve the user experience compared to traditional DEXs and bridges. To illustrate the key differences between swapping via intent-based protocols and through conventional DEXs and bridges, we’ve created a detailed table for your reference

| Aspect | Intent-Based Protocols | Traditional DEXs & Bridges |

| User Experience | Consumer-facing intent-based apps are not yet widely adopted, right now it’s rather a b2b tool (API, SDK). | Users must manually navigate multiple steps, including selecting exchanges, managing wallets across different chains, and handling bridging operations. |

| Execution Efficiency | Professional market makers or solvers compete to fulfill user intents, leveraging advanced strategies to optimize execution, often resulting in reduced slippage & better pricing for smaller trades. | Execution relies on AMMs or order books, which may result in low liquidity or high volatility. However, usually bridges have better rates for bigger amounts, as they often have more liquidity. |

| Cross-Chain Interoperability | Facilitates seamless cross-chain transactions by abstracting the complexities of interacting with multiple blockchains, allowing users to focus on their desired outcomes without managing the technical details.However, solvers themselves still use bridges or CEXs to perform the swaps. | Cross-chain operations require users to manually bridge assets between networks, sometimes involving multiple transactions. |

| Risk Management | Intents provide users with a more secure and predictable experience, removing slippage and MEV attacks. | Users are directly exposed to risks like slippage and MEV exploits, requiring them to implement their own risk mitigation strategies. |

| Cost & Speed | By minimizing on-chain interactions and leveraging aggregated liquidity, intent-based protocols can offer reduced transaction costs and faster execution times. | Transactions may incur higher fees and longer processing times due to multiple on-chain operations and network congestion. However, leading bridges are now very often as fast as the solvers of intents. |

Nevertheless, DEXs and bridges aren’t going anywhere – at least for now.On the contrary, they’re actively integrating solvers into their routing. Although the chain abstraction narrative and intent-based protocols are still in their early stages, they will be gradually shaping the future of DeFi.

For now, the smartest approach for both beginners and experienced traders is to leverage a powerful crypto swap aggregator. The ideal choice? One that seamlessly integrates DEXs, bridges, and intent-based protocols to offer the best possible rates and efficiency…And Rubic, the ultimate Best Rate Finder, is just the right one. By uniting DEXs, bridges, and intent-based protocols under one roof, Rubic ensures smooth, fast, and cost-effective swaps.

The Perfect Balance: Aggregation as the Key to Efficiency

Let’s revisit the table we provided earlier. DEXs and bridges come with some drawbacks: users can encounter risks such as MEV-bot attacks, high slippage, and low liquidity. They don’t always secure optimal pricing, especially for smaller traders or during low liquidity or high volatility, and transactions sometimes incur higher fees and longer processing times due to multiple on-chain operations and network congestion.

Similarly, intent-based protocols have their own limitations, such as risks associated with solver manipulation, delays, reliance on third parties, and other inefficiencies.

While we all imagine a chain-abstracted future – one seamless superapp for all crypto needs – the best approach today is aggregation. By integrating existing solutions, we can offer users the fastest and easiest experience. Rubic has achieved ultimate success in this, bringing together the best of all worlds to provide a frictionless cross-chain experience.

Rubic: DEXs, Bridges & Intent-Based Protocols Aggregation

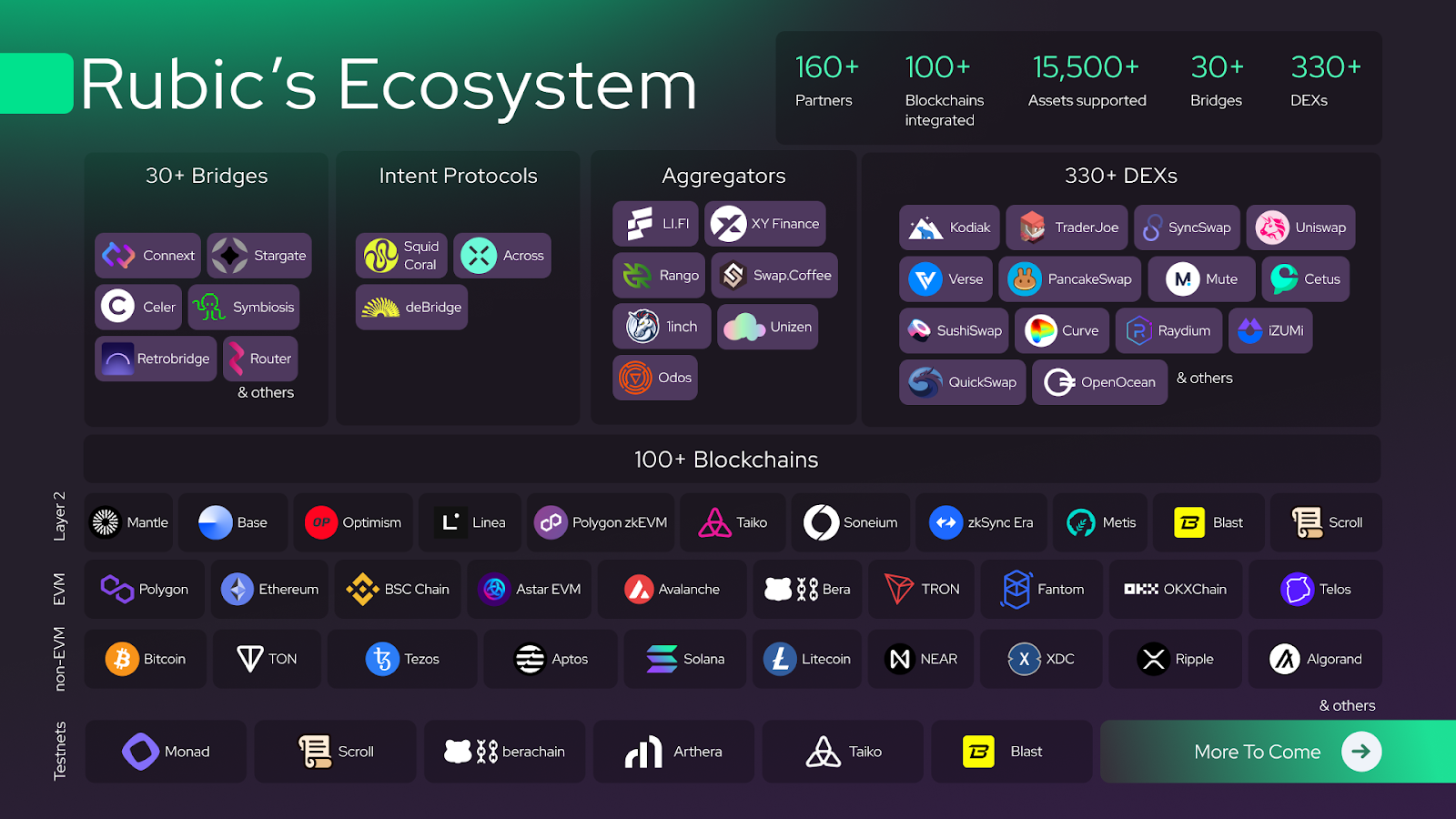

Rubic’s core mission has always been to become the ultimate Best Rate Finder. Following this vision, we were the first to integrate both DEXs and bridges, ensuring users could access the best liquidity across multiple networks. Then, we took it a step further by incorporating DEX aggregators, evolving into the “aggregator of aggregators.”

Now, we are entering the next phase – integrating intent-based protocols. This marks a major leap in streamlining cross-chain swaps, making crypto chain abstracted and user-friendly!

Among 360+ DEXs and cross-chain providers Rubic is aggregating, there are a number of leading intent-based protocols – DeBridge, Across, and Coral (Axelar). This intent-based approach allows both projects to offer features such as:

- Near-instant settlement: Transactions are settled quickly as solvers compete to fulfill orders promptly.

- Zero slippage: Users receive the exact amount specified in their orders, eliminating slippage concerns.

- Unlimited market depth: The network’s design allows handling trades of any size without the constraints of liquidity pools.

By shifting from traditional bridging to an intent-based model, these protocols aim to provide a more secure, efficient, and scalable solution for cross-chain value transfers.

Intent-based protocols are still in the minority, which is why aggregators play a crucial role in fully meeting users’ needs. While deBridge supports swaps across 21 chains, Across covers 18, and Coral by Squid supports 5 chains, Rubic aggregates over 100 networks, ensuring seamless interoperability across them all.

Aggregators like Rubic are the true drivers of blockchain interoperability. By integrating 360+ DEXs, bridges, & intent-based protocols Rubic guarantees users fast access to newly launched chains without liquidity constraints, providing a frictionless cross-chain experience.

The Power of Aggregation

So, what exactly are the benefits of aggregating all existing solutions? Let’s take Rubic as an example and see what it enables:

- Intent-Based Protocols Integration: Rubic aggregates multiple intent-based protocols, leveraging solvers to provide MEV protection and secure the best possible rates – without relying solely on DEX liquidity pools.

- 360+ DEXs & Bridges Aggregation: Users can seamlessly swap across 100+ chains, including trending ones like Monad and Bera, without dealing with blockchain complexities.

By combining the strengths of both solutions, we eliminate their individual drawbacks – creating a seamless, efficient, and optimized cross-chain experience.

Final Thoughts

Intent-based protocols represent the future of cross-chain bridging. We’re gradually moving closer to achieving fast and cheap cross-chain swaps, but for now, aggregation remains the ultimate solution. While intent-based protocols still face challenges – such as a shortage of solvers – DEXs and bridges continue to play a crucial role in keeping the ecosystem functional.

So, let’s keep building!