Rubic: A Cross-Chain Tech Aggregator for the Interoperable Future of Web3

Today, the crypto market is overflooded with newly-launched blockchains and projects, so clearly, this trend is likely to continue in the future. It is still complicated for users to move assets across chains and for projects to communicate with one another for higher scalability. Which solutions have appeared on the market to unify this fragmented landscape and increase blockchain interoperability? What is Rubic and why will its Cross-Chain Tech Aggregation Layer facilitate Web3 development?

The Cryptocurrency Market Needs Interoperability

With liquidity being distributed over different chains, interoperability has become a necessity, rather than just a trend. Today, the blockchain space lacks a viable cross-chain infrastructure to interconnect all crypto projects.

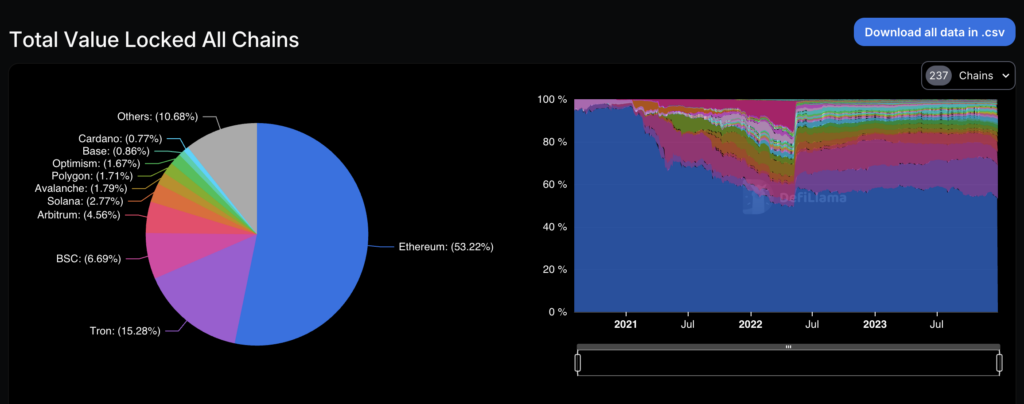

According to DeFiLlama, presently, there is $52.2B+ distributed over different chains, with Ethereum, Tron, and BSC leading the way.

Every crypto project resides on a certain blockchain that serves different purposes: Ethereum is considered the safest, Tron is a home for stables, Polygon and Solana are cheap & popular for NFTs, while L2s are cheap, fast, and secure. At this moment, there are about 237 chains operating and over 20,200 tokens in circulation (and Rubic supports over 15,500 of those tokens!). This drives the need for enhanced interoperability amongst all of them and to make the assets available cross-chain.

Developers spend weeks and months making their dApps interoperable across chains, researching and integrating cross-chain bridges, non-EVMs, Layer 2 and Layer 1 networks that are not unified. Most commonly, integration of one of them is not enough to gain interoperability on all levels. Thus, projects have to seek further integration, seeking an all-in-one solution so as to become fully cross-chain. This makes the overall development time-consuming and expensive while halting blockchain technology to a standstill.

How to Harness Cross-Chain

As the blockchain sphere started to move towards interconnected networks and Web3, the market came up with several cross-chain solutions and models based on the type of data being transferred cross-chain, as well as on the way this data is being transferred. Bridges are capable of enabling token and NFT swaps, Layer 0 networks, signals, oracle transfer states, proofs, calls, events, and other data. However, these cross-chain tools lack unified standards and make developers spend weeks or months on research plus integration, which cost significant human and financial resources.

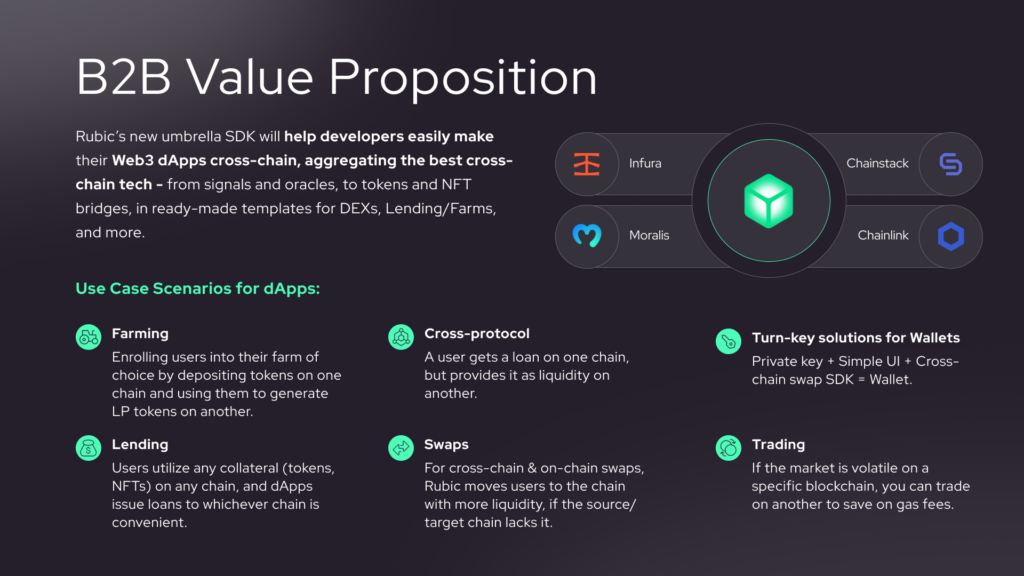

Let’s have a look at different cross-chain solutions which exist on the market right now, and which will soon be aggregated under Rubic’s umbrella SDK. Our vision is that Rubic’s new umbrella SDK will aggregate the best Web3 cross-chain tech — from signals and oracles, to tokens and NFT bridges, in ready-made templates for DEXs, Lending/Farms, and more. This will help developers easily make their Web3 dApps cross-chain, regardless of what their function is.

Bridges

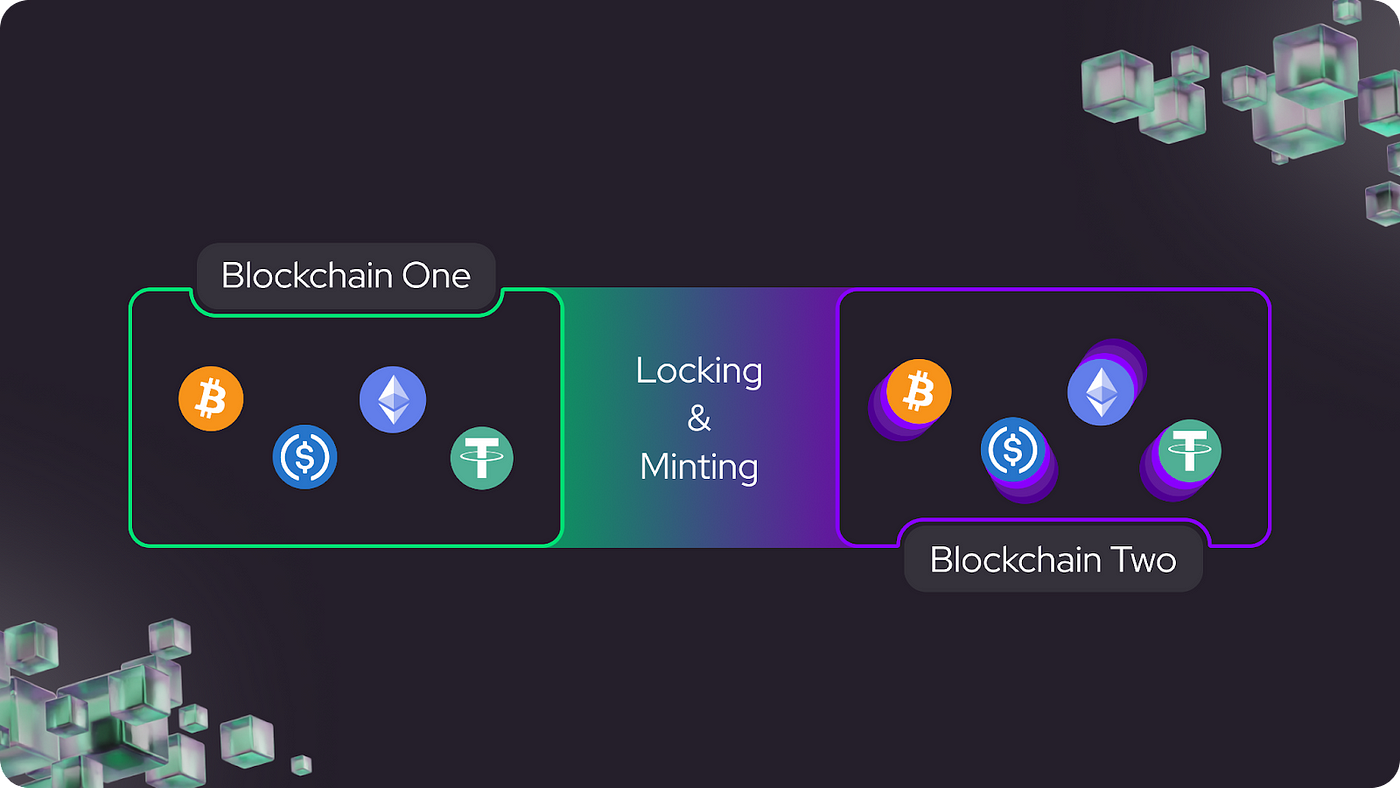

A bridge enables transactions between two networks, be they Layer 1, Layer 2, or even an off-chain service. Simply put, bridges allow users to transfer their assets from one network to another. Bridges, however, do not move assets between chains, they link assets on one network to their representations (i.e. wrapped versions) of assets on another network.

Bridges move the same assets between two blockchains in a paired manner, for example — USDC (ERC-20) into USDC (BEP-20).

Bridges were the first solutions for cross-chain transfers, yet with significant detriments:

- Low security: As evidenced, attacks on bridges account for 69% of total funds stolen in 2022.

- The excessive amount of time spent on a swap: Several minutes and numerous actions needed to perform one swap.

- One bridge is never enough to scale up. Integrating many of them takes up a large amount of developer resources.

- Bridges are limited in terms of swapping volume, while some of them are also limited to stablecoins and native assets.

Some of the popular cross-chain bridges are cBridge, Squid Router, Wormhole, Symbiosis, deBridge, and Allbridge.

Cross-Chain Messaging Protocols

Cross-chain messaging protocols help to send data, like NFTs, messages, tokens, etc., to any other blockchain.

● Signals move a wider range of information types between chains than bridges — contract calls, proofs, and states.

● They can be limited in functionality and operation (e.g. IBC protocol is expensive and inconvenient for chains outside of the Cosmos ecosystem).

● They’re pretty complex and require a certain degree of expertise, increasing development team resources & integration times.

Among the established cross-chain messaging protocols are the Inter-Blockchain Communication (IBC) Protocol IBC, Anycall, Celer IM, Synapse protocol, Layer Zero, and Nomad.

Cross-Chain Oracles

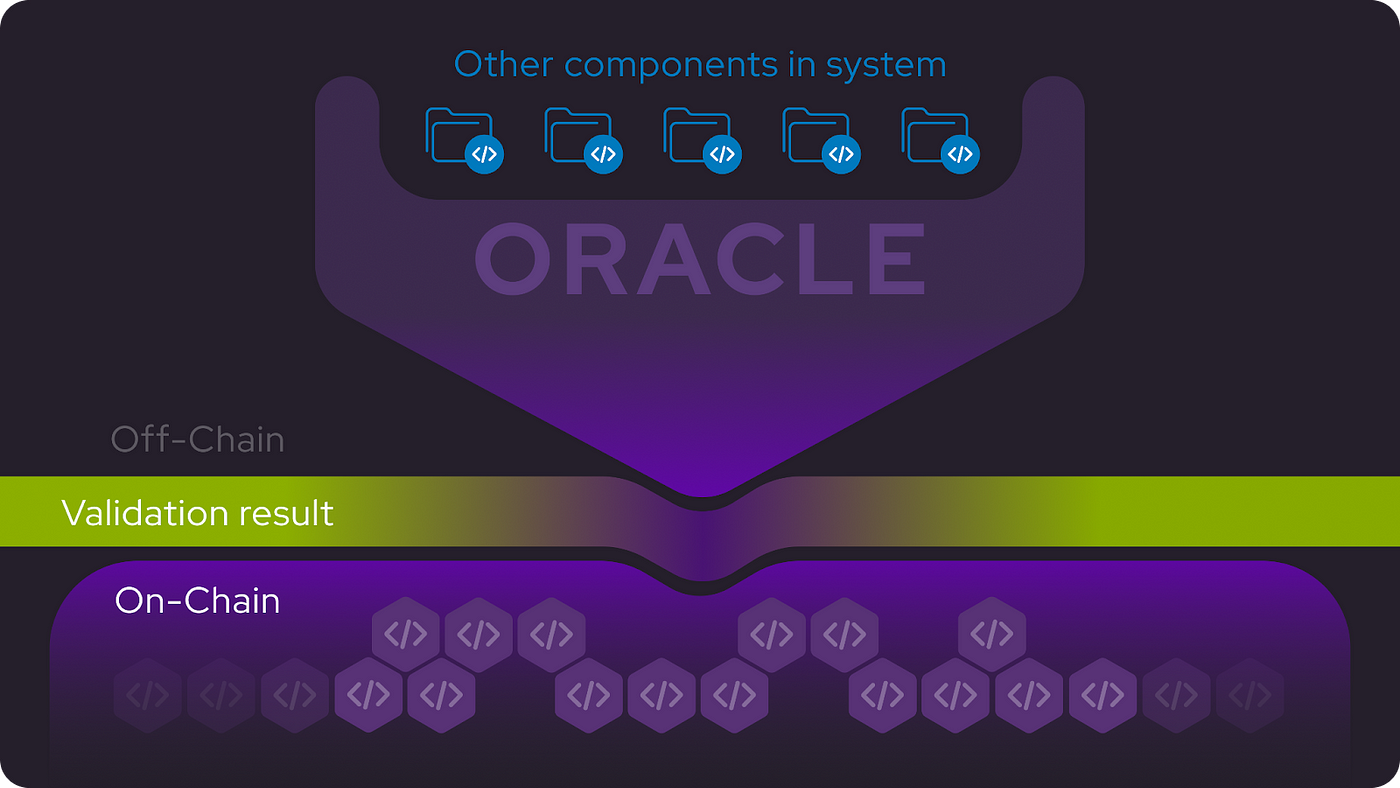

Cross-chain oracles serve as middleware that connects blockchains to external (off-chain) third-party clients and services, allowing smart contracts to interact with external data sources or connect to an off-chain system.

● You need to know how to set up and run nodes, which takes time and effort.

● Knowledge and expertise in blockchain tech (e.g. deploying smart contracts) are required.

● Cost: Oracles require a high investment in infrastructure and maintenance costs.

● Third-party collusion: Since oracles rely on multiple sources to pull information on-chain or between blockchains, they are susceptible to third parties colluding to manipulate data or perpetrate fraud.

● Long duration: The time needed for aggregating data from multiple sources and arriving at a consensus is long. If all the network oracles need to reach a quick consensus, then the speed of individual oracles is the determining factor.

Examples: Band protocol, API3, Chainlink.

Cross-chain Aggregators

Cross-chain aggregators integrate blockchains, bridges, and DEXs, enabling token swaps across chains and providing profitable prices and fast timings, finding the optimal transaction route amongst multiple integrated providers.

● They come with a more friendly UI and UX: A one-click user experience, with the possibility of changing the token that is being moved across chains.

● They support a bigger number of blockchains and tokens, using different cross-chain liquidity sources: Networks, DEXs, and bridges, therefore offering sufficient liquidity.

● Different options to integrate — as an SDK/API and as a widget to plug directly into projects, with no need for expertise or deeper understanding of blockchain technology.

● Enhanced security (elaborated mechanisms to keep transactions secure): Continue operating even if a bridge gets hacked, routing transactions through another bridge.

Examples: Rubic, Rango, LI.FI, XY Finance.

To wrap up, cross-chain aggregators and their cross-chain tools ease the process of making networks and projects interconnected, providing superior user experience and security, as well as convenient tools for dApps, which do not require much knowledge to integrate.

Rubic’s New Positioning: A Cross-Chain Tech Aggregator

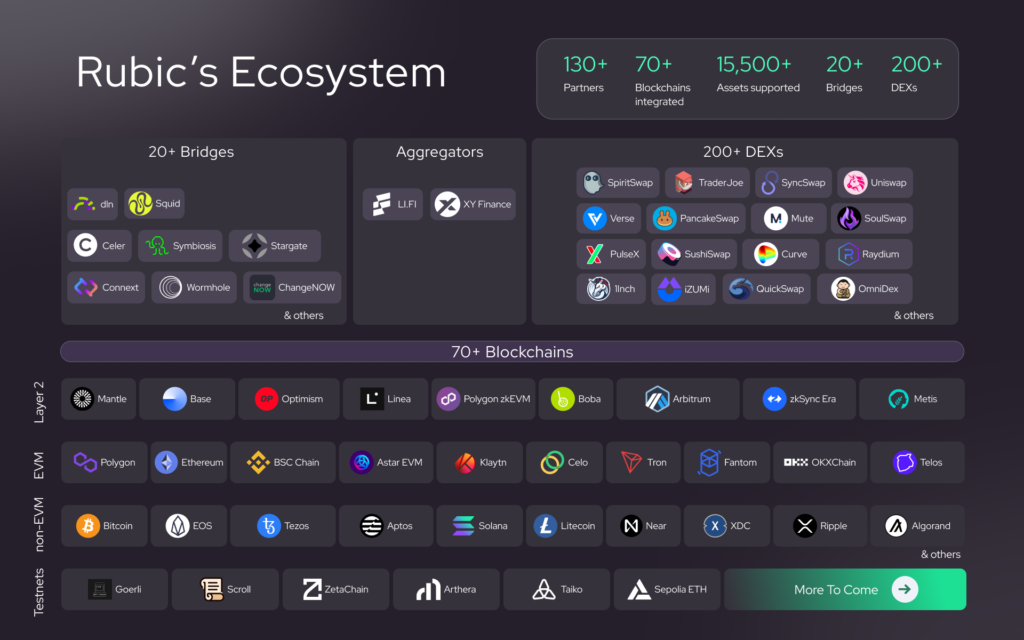

Rubic aggregates 70+ blockchains and testnets, while it enables swaps of 15,500+ assets with the best rates, highest liquidity, and transaction speeds — in one click, thanks to the integration of 220+ DEXs and bridges.

Users no longer have to roam across Web3 to compare rates and liquidity; they can make cross-chain and on-chain swaps of any available token to any other one on https://app.rubic.exchange/.

We also provide tools for dApps to enable cross-chain swaps. Rubic’s functionality can be implemented by any crypto project willing to become interoperable, with an easy-to-install widget and fully customizable SDK.

Potential Cross-Chain Use Cases of the New Rubic SDK

As soon as cross-chain becomes a common sight in the blockchain sphere, developers will strive for an all-inclusive solution; embracing all cross-chain features and upgrading their dApps on all sides at once. Rubic aims to become the ultimate destination for those who want to go cross-chain in the most cost-efficient and fastest way — delivering the full set of cross-chain functions to projects. Here there are different use cases that can be realized through Rubic’s cross-chain technology:

Rubic’s New Business Model

Our future revenue model is to be based on several streams:

The classic transaction fee model is based on the number/volume of transactions going through Rubic, directly or via integrators.

Revenue share with bridges. Being part of the Rubic ecosystem, bridges get additional revenue and volume streams, which they can eventually share with us.

Blockchain integration fees. Integration into Rubic creates one more distribution channel for blockchains, by making them available for other chains and projects as well.

Protocol / SDK / Widget Subscription fees. Projects that opt for Rubic’s SDK open up their platforms to the rest of the blockchain space, and in turn, pay the subscription fee for maintaining the cross-chain interoperability on their platform.

RBC: The Fuel of the Protocol

We have recently relaunched our token together with the new Tokenomics, as well as upgraded RBC’s token utility:

- SDK subscriptions & integration service fees in RBC

- Grant programs for SDK integrators will be covered in RBC

- Governance: Token holders can participate in decentralized decision-making

- Low fees for RBC holders: Cut costs of cross-chain calls, exchange fees, and gasless fees

- Distribution of partners’ airdrops to RBC holders

What Has Rubic Achieved Today?

The Rubic Cross-Chain Aggregator is a superior tech in the realm of cross-chain swaps, aggregating over 15,500 tokens across 70+ blockchains, with over 220 DEXs and bridges. The Rubic app is used by more than 253,000 users, with a total swapping volume of more than $550M.

Its market-proven SDK and widget have allowed for reaching more than 130 projects across the blockchain industry. Today, 130 out of 2,150 live dApps currently operating on the market have become interoperable with Rubic, which accounts for 6% of the total number of live dApps on the market. Today, Rubic generates up to 32% of volume to some of its integrated cross-chain providers, playing a massive role in their ecosystem development while bringing more users and transactions to their platforms.

Battle-tested by the market, Rubic’s SDK and widget have led the pack in several ways:

- A huge number of tokens and DEXs supported: 15,000+ tokens for swapping (out of 20,200 tokens circulating in the crypto market) and 200+ aggregated DEXs that provide the best transaction routes and sufficient liquidity.

- Best UX/UI with a one-click experience. Сross-chain swaps have a complicated route — Swap -> Bridge/DEX -> Swap — which Rubic packs into a one-click transaction.

- Best rates & trade times. On Rubic, the average transaction time takes around 90 seconds. The algorithm used at Rubic optimizes transactions to save on gas and fees, thus finding the best deal on the market.

- Security & liquidity. Due to the aggregation of DEXs, providers, and bridges, users get guarantees for sufficient liquidity when making a swap. No user’s funds have ever been kept on Rubic’s platform; every transaction is performed by sending calls to Rubic’s providers’ smart contracts. As always, Rubic’s technical support is available 24/7.

- Low swap fees. No matter what amount of crypto you swap, for any on-chain transaction, you always pay just a $1 on-chain fee and just $2 for cross-chain, without the need to count your swapping expenditures!

With Rubic’s Cross-Chain SDK and widget, many projects are already interconnected with one another by enabling cross-chain token trading.

While being a hidden gem in the cryptocurrency space, Rubic is already the pioneer of the interoperable Web3 world. To start using Rubic now means to make a huge step toward the future interoperable Web3 world.