Is Solana a Good Investment? A Comprehensive Guide (2025)

TL;DR

- Solana is a high-performance, low-cost blockchain that has expanded its ecosystem with thousands of decentralized applications since its 2020 launch.

- Its impressive transaction speeds (over 65,000 TPS) and sub-cent fees make it attractive compared to other blockchains like Ethereum.

- The network’s technical innovations, such as its Proof of History consensus, have driven growing institutional adoption and developer activity.

- Solana can be a great investment. However, potential as an investment depends on balancing its technological promise against inherent crypto market risks and regulatory uncertainties.

Solana is a high-performance, low-cost blockchain, and Solana has gained traction among developers and investors. Since its launch in 2020, Solana’s ecosystem has expanded dramatically, now hosting thousands of decentralized applications spanning DeFi protocols, NFT marketplaces, and Web3 platforms.

As an investor, you may ask, “Is Solana a good investment in 2025?”. However, by looking at its fundamental value propositions: transaction speeds exceeding 65,000 TPS, fees averaging under $0.01, and a thriving developer community building the next generation of blockchain applications, you may feel drawn to it.. Solana’s long-term potential has been demonstrated through its resilience during market downturns and its ability to maintain its position among the top cryptocurrencies by market capitalization.

The Solana investment thesis centers on its technical advantages over competitors, growing institutional adoption, and expanding use cases across the crypto space. From its innovative Proof of History consensus mechanism to its strong tokenomics, SOL continues to attract both retail and institutional capital seeking exposure to high-performance blockchain technology. When evaluating Solana for your portfolio, consider both its technological promise and the inherent volatility of cryptocurrency markets.

What is Solana (SOL) and How Does It Work?

A Brief Overview of Solana

Solana is a high-performance blockchain platform launched in 2020 by Anatoly Yakovenko. It’s different because it aims to solve the classic security, decentralization, and expansion trilemma, without sacrificing any of the three, thus making it unique. What Solana does is that it validates transactions differently, and it also uses PoS and PoH. It handles 65,000 transactions a second, so it is fast, therefore, it confirms transactions in under 1 second. It is cheap because it costs less than 1 penny, thus making it an attractive option.

The Role of $SOL in the Ecosystem

The native token, SOL, serves multiple functions within the Solana ecosystem:

- Transaction fees payment

- Staking for network security and validator rewards

- Governance participation

- Collateral in DeFi applications

SOL’s utility extends beyond simple value transfer, making it integral to Solana’s growing ecosystem of decentralized applications.

Suggested Read: What Is An SPL Token? A Complete Guide to Solana’s Token Standard

Why Are Investors Interested in Solana?

Unmatched Speed and Low Transaction Costs

Solana’s primary attraction for long-term investors lies in its revolutionary throughput capabilities. While Ethereum processes 15-30 transactions per second, Solana consistently delivers over 65,000 TPS with sub-second finality. This performance isn’t just theoretical—it’s actively supporting millions of daily transactions across the network.

For investors asking, “Is Solana a good investment? This technical advantage translates to real-world utility. Transaction fees averaging under $0.01 make micropayments viable and complex DeFi operations cost-effective, addressing a critical pain point in blockchain adoption. As traditional finance increasingly explores blockchain integration in 2025, Solana’s ability to handle Visa-level transaction volumes without congestion positions it favorably for enterprise adoption.

The Solana price prediction models from major analysts frequently cite this scalability advantage as a fundamental driver of potential value appreciation, particularly as network effects strengthen with growing usage.

Thriving Developer Ecosystem

The Solana investment thesis is significantly supported by its expanding developer community. Recent ecosystem reports show remarkable growth metrics:

- Over 2,500 daily active developers (up 40% from 2024)

- More than 2,000 active projects spanning DeFi, NFTs, gaming, and social applications

- $1.2 billion in developer grants and incentives distributed through the Solana Foundation

- 300+ monthly hackathon submissions demonstrating continuous innovation

This developer momentum creates a virtuous cycle for Solana’s long-term prospects. New applications attract users, increasing network activity and SOL utility, which in turn attracts more developers. The ecosystem now includes sophisticated DeFi primitives, institutional-grade trading platforms, and consumer applications with mainstream appeal all factors that strengthen Solana’s fundamental value proposition.

Institutional Adoption and Partnerships

Institutional interest in Solana has accelerated significantly, providing validation for investors considering SOL for their portfolios. Notable developments include:

- Major payment processors are integrating Solana for USDC settlements

- Venture capital firms are establishing dedicated Solana ecosystem funds exceeding $500 million

- Traditional finance platforms offering Solana staking and yield products

- Enterprise blockchain solutions building on Solana for supply chain and identity management

- Gaming studios developing AAA titles with Solana-based digital economies

These partnerships extend beyond speculative interest, representing genuine adoption of Solana’s technology for practical applications. For Solana analysis, this institutional engagement signals confidence in the network’s long-term viability despite historical volatility in the broader crypto market.

Solana’s Historical Performance & Market Trends

Key Price Milestones & Market Cycles

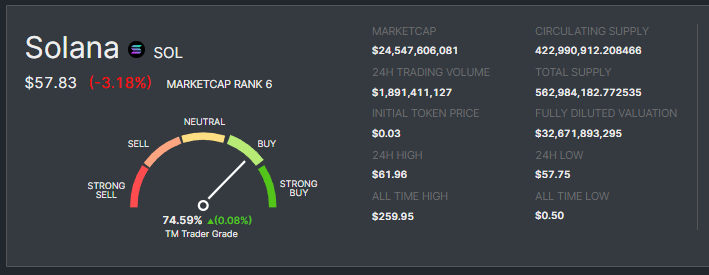

Solana’s price history illustrates the dramatic volatility characteristic of high-potential blockchain investments. From its humble beginnings at approximately $0.50 during its 2020 launch, SOL experienced a meteoric rise during the 2021 bull market, surging over 52,000% to reach its all-time high above $260 in November 2021. This extraordinary growth was followed by an equally severe correction during the 2022 crypto winter, when SOL plummeted below $10, losing over 95% of its peak value as network outages and broader market sentiment weighed heavily on investor confidence. The recovery phase through 2023-2024 demonstrated Solana’s resilience as the price gradually reclaimed the $100+ territory amid ecosystem expansion and improved network stability. In 2025, SOL has continued to exhibit significant price movements, fluctuating between $180-$120 as investors balance Solana’s technological advantages against market cycles and competitive pressures.

This pronounced volatility underscores both the substantial potential rewards and considerable risks inherent in Solana investment, highlighting why thorough research and risk management are essential for anyone considering SOL for their portfolio.

How Solana Has Performed Compared to Other Cryptos

Solana is not like Bitcoin and Ethereum; it is unique in its own right, and Solana is much faster and lower cost than Bitcoin and Ethereum. In 2025, the Solana blockchain will be able to handle a lot more transactions than any other blockchain, because the transaction fees are also likely to be less than 1 cent. In terms of price, however, Solana has seen a lot of ups and downs; thus, in 2021, it reached an all-time high of $260. But in 2022, it dropped to less than $10. However, in 2025, it again reached its all-time high of $294, making it one of the top 10 cryptocurrencies.

The price of the token follows the fluctuations of the market, and according to USA Today, Solana has gained more users in DeFi, NFT, and Web3. Institutions are also embracing it, because Solana is superior to Ethereum in a few ways, thus it has more daily active users and more new wallets. In 2024, Solana surpassed Ethereum in the number of new projects, so Solana is relatively low-cost and fast, which is why it is preferred by the creators of NFTs and DeFi; however, Ethereum is more secure and has a larger user base.

Bitcoin and Solana are not the same, and Bitcoin is nothing but a store of value, therefore, Solana can do everything banks do but faster and cheaper, thus it is a more versatile option.

Key Factors That Have Influenced Solana’s Price

Several factors have historically impacted Solana’s price:

- Network performance issues and outages

- Overall crypto market sentiment

- Institutional adoption announcements

- Technical upgrades and roadmap achievements

- Regulatory developments affecting the broader crypto market

The Risks & Challenges of Investing in Solana

Network Reliability Concerns

Solana’s biggest weakness is reliability, and since 2021, the network has gone down multiple times. In 2021, the network went down for a total of 17 hours, so the first quarter of 2023 saw the network go down for 3 hours due to an issue with the leader election process. The final quarter of 2024 saw two partial outages that prevented the network from producing new blocks and temporarily halted transaction processing because the failures were due to the tradeoff between speed and redundancy.

Solana has sacrificed redundancy for speed, causing this weakness, therefore, the Solana Foundation has been working on making the network more reliable. The Validator Client fixed the leader election issue, thus, the foundation has also looked at congestion management. The Solana Foundation says the network is becoming more reliable, and each outage has been less severe than the last. However, it is a major weakness that other blockchain platforms emphasize in their marketing, so this is a major concern for Solana’s growth and development.

Competitive Landscape Pressures

The Layer-1 blockchain space is getting crowded, and this makes it tough for Solana to carve out a niche as an investment. Ethereum’s shift to Proof-of-Stake, and its scaling solutions (such as rollups and sharding), are starting to erode Solana’s advantages in speed and cost, thus this is all while new blockchains, armed with new tech, are entering the market, each claiming to be better in some way.

Meanwhile, incumbent blockchains like Avalanche, Cardano, and Polkadot already have strong developer communities and institutional support, and they are spreading available talent and capital thinner, because this competition means that Solana will need to continue to innovate while maintaining backwards compatibility.

This competition is not just technological; it is also over the developers and projects, so many blockchains are offering large incentives to attract talent, and Solana will need to continue to fight for its position in this competition, therefore, it will be a challenging task.

Can Solana continue to grow its developer ecosystem and maintain its competitiveness? This will be a key factor in determining whether Solana is a good investment for 2025 and beyond; thus, the answer to this question will have a significant impact on its future growth and price predictions.

Regulatory Uncertainty

Like all cryptocurrencies, Solana faces an evolving regulatory landscape that creates significant investment risk. While recent frameworks in major economies have provided some clarity, the classification of tokens and compliance requirements continues to evolve unpredictably. The SEC’s ongoing scrutiny of crypto projects, particularly those with token sales similar to Solana’s initial funding rounds, creates regulatory overhang that can impact SOL’s value and utility.

Global regulatory divergence further complicates Solana analysis, as different jurisdictions adopt varying approaches to cryptocurrency governance. Some countries have embraced crypto innovation with favorable regulations, while others have implemented restrictive policies or outright bans. This patchwork of regulations creates compliance challenges for projects building on Solana and may limit the addressable market for Solana-based applications.

Institutional investors conducting Solana analysis must factor these regulatory risks into their investment thesis, particularly as central banks worldwide explore central bank digital currencies (CBDCs) that could either complement or compete with existing cryptocurrency networks like Solana.

Future Outlook: Can Solana Continue to Grow?

Solana’s Roadmap and Upgrades

Solana’s development team continues to prioritize network stability and performance. Recent upgrades have focused on:

- Improved validator performance

- Enhanced network resilience

- Better developer tools and infrastructure

- Scaling solutions for growing demand

The roadmap for 2025-2026 includes further decentralization efforts and cross-chain interoperability improvements.

Adoption in DeFi, NFTs, and Web3

Solana’s ecosystem has shown remarkable growth across key sectors:

- DeFi: Total Value Locked (TVL) has reached significant levels, with lending, trading, and yield farming protocols flourishing

- NFTs: Solana has established itself as a leading alternative to Ethereum for NFT projects, with lower fees attracting creators and collectors

- Web3: Gaming, social media, and identity solutions built on Solana continue to gain traction

How Solana Compares to Ethereum in the Long Run

While Ethereum maintains its first-mover advantage and largest developer community, Solana’s technical advantages and growing ecosystem position it as a strong competitor. The relationship may evolve toward complementary roles rather than winner-takes-all competition, with different blockchains serving different use cases.

How to Buy & Trade Solana (SOL) Safely

Purchasing SOL is straightforward through major exchanges:

- Create an account on a reputable exchange (Binance, Coinbase, Kraken)

- Complete identity verification

- Deposit funds

- Purchase SOL through spot trading

- Consider decentralized options like Rubic for direct swaps

With Rubic, you can directly swap your cryptocurrencies with SOL without any need to create an account or KYC. For traders looking to convert between Ethereum and Solana, Rubic offers efficient ETH to SOL and SOL to ETH swaps.

Storing SOL Securely

Security should be a priority when investing in SOL:

- Hardware wallets (Ledger, Trezor) offer the highest security

- Software wallets like Phantom and Solflare provide a good balance of security and convenience

- Consider cold storage for long-term holdings

- Never share private keys or seed phrases

Swapping Solana on Rubic: A Seamless Trading Experience

Why Swap SOL on Rubic?

Decentralized exchanges offer several advantages for SOL trading:

- No KYC requirements

- Self-custody of funds

- Access to new spl tokens early

- Cross-chain capabilities

- Competitive rates through aggregation

How to Swap SOL and SPL Tokens on Rubic

- Connect your Solana wallet (Phantom, Solflare)

- Select trading pairs

- Review rates and fees

- Confirm transaction

- Receive tokens directly to your wallet

The process is typically completed in seconds with minimal fees compared to centralized alternatives.

Conclusion: Should You Invest in Solana?

When considering Solana as a potential addition to your portfolio, you should evaluate its technological advantages, growing ecosystem, expanding user base, and developer community. Solana offers impressive transaction speeds and minimal fees, making it attractive for various blockchain applications.

Is Solana a good investment for you? This depends largely on your personal risk tolerance and investment timeline. Before making a decision, assess how it fits within your broader investment strategy and avoid concentrating too much capital in any single cryptocurrency asset.

Understanding blockchain fundamentals is essential when evaluating cryptocurrency investments, as is recognizing the inherent volatility of these markets. Only invest funds you can afford to lose, and consider dollar-cost averaging to mitigate risk. While many analysts see promise in Solana’s long-term prospects given its technological capabilities, always conduct thorough research before committing capital to any cryptocurrency.

FAQ

Is Solana a safe investment?

Solana carries the inherent risks of all cryptocurrency investments, including volatility and regulatory uncertainty. Technical risks specific to Solana include past network outages. However, its established position and continued development make it relatively safer than newer, unproven projects.

What are the biggest risks of investing in SOL?

The primary risks include network reliability issues, competition from other blockchains, regulatory changes, and general crypto market volatility. Technological obsolescence remains a long-term concern for all blockchain projects.

Does Solana have long-term potential?

Solana’s technical advantages, growing ecosystem, and developer interest suggest long-term potential. However, success depends on addressing reliability issues and adapting to evolving market demands and regulatory landscapes.

Can Solana reach its all-time high again?

While possible, predicting specific price targets is speculative. Solana’s ability to reach new highs depends on broader crypto market conditions, continued ecosystem growth, and successful technical improvements.

Is it worth buying Solana now?

The current market position should be evaluated against your investment strategy and risk tolerance. Consider dollar-cost averaging and thorough research before making any investment decision.

How does Solana compare to Ethereum for investors?

Ethereum offers greater ecosystem maturity and developer adoption, while Solana provides superior transaction speeds and lower fees. Investment considerations should include your belief in each platform’s long-term vision and technical approach.

Where can I trade SOL with low fees?

Centralized exchanges like Binance offer competitive fees for SOL trading. For decentralized options, platforms like Rubic aggregate multiple DEXs to find optimal rates for Solana swaps.