What Is deBridge Finance? A Deep Dive by Rubic

TL;DR

- deBridge Finance is a decentralized protocol that facilitates cross-chain liquidity and asset transfers between multiple blockchain networks, enhancing interoperability within the decentralized finance (DeFi) ecosystem

- deBridge addresses liquidity fragmentation with its innovative solutions, enabling seamless multi-chain dApp development and expanding DeFi use cases.

- The protocol ensures security and decentralization through a validator network and rigorous audits.

- With future growth and modular interoperability in focus, deBridge continues to lead cross-chain solutions.

deBridge Finance is a decentralized cross-chain liquidity network designed to solve the pressing issues of liquidity fragmentation and interoperability across blockchains. In this article, we will figure out this new protocol, deBridge Finance, its key features, functionality, and how it is paving the way for seamless cross-chain asset transfers and messaging between different blockchains.

What is deBridge Finance?

deBridge Finance is a decentralized protocol that facilitates efficient cross-chain liquidity and asset transfers across multiple blockchain networks. It enables users to execute cross-chain swaps and transactions while ensuring high security, low fees, and interoperability between blockchain ecosystems.

At its core, deBridge enables seamless communication between various blockchains, eliminating the barriers that currently exist in traditional cross-chain operations. The platform integrates deBridge Token (DBR) to power its decentralized governance and incentivization structure, contributing to the stability and long-term growth of the ecosystem.

Key Features of DeBridge

Cross-Chain Liquidity and Asset Transfers

One of the standout features of deBridge is its ability to provide cross-chain liquidity for users across different networks. By allowing users to transfer assets from one blockchain to another, deBridge ensures liquidity flows smoothly between chains without relying on centralized exchanges. The protocol facilitates frictionless and secure transactions, enabling users to trade assets at competitive prices across various blockchain platforms.

DeSwap Liquidity Network (DLN)

The DeSwap Liquidity Network (DLN) is a crucial component of deBridge. It allows users to place limit orders across blockchains, which are then fulfilled by Solvers who have the liquidity to execute the transaction. DLN improves the cross-chain liquidity experience by enabling users to take advantage of the best prices available across multiple chains.

Cross-Chain Messaging

DeBridge is not just about asset transfers; it also enables cross-chain messaging. This capability allows for secure communication between smart contracts across different blockchains, making it possible for decentralized applications (dApps) to seamlessly interact across different networks. By utilizing deBridge’s messaging infrastructure, developers can integrate cross-chain communication into their projects with ease.

Developer Tools and APIs

DeBridge offers a comprehensive suite of developer tools and APIs to streamline the integration of its features into dApps and other blockchain projects. Developers can access the cross-chain crypto exchange and bridge API, making it easier than ever to integrate cross-chain liquidity into their decentralized applications. These tools are designed to reduce development time and enhance the scalability of blockchain solutions.

Governance and the dBridge Token

DBR is the native governance token of deBridge. Holders of DBR tokens have voting power over protocol upgrades, new feature implementations, and the direction of the project’s development. By utilizing a decentralized governance model, deBridge ensures that the community plays an integral role in the decision-making process, contributing to the platform’s decentralization and transparency.

How Does DeBridge Work?

The deBridge Finance protocol consists of two key smart contracts: the DlnSource and DlnDestination contracts. These contracts interact with each other to facilitate cross-chain transactions while ensuring that orders are fulfilled in a secure and efficient manner.

Core Architecture

At the heart of deBridge’s architecture is its ability to interact with multiple blockchains through interoperability protocols. The DlnSource contract locks the asset on the source chain, while the DlnDestination contract ensures that the corresponding asset is supplied on the destination chain. Once the conditions are met, the transaction is completed, and the assets are exchanged.

Supported Blockchains

DeBridge supports a variety of blockchains, making it easy for users to transact across multiple ecosystems. Whether you want to swap assets between Ethereum and Solana or any other blockchain, deBridge has you covered. The protocol ensures that assets can be securely transferred across chains with minimal friction.

Security Features

Security is paramount in the DeFi space, and deBridge has implemented multiple security features to protect users’ assets. The platform uses advanced cryptography, smart contract audits, and a validator network to ensure that all transactions are secure. Additionally, deBridge offers a risk mitigation strategy to protect against potential exploits or vulnerabilities.

Tokenomics of DBR

The DBR token is central to the operation and governance of the deBridge Finance protocol. As deBridge progresses towards full decentralization, the DBR token is designed to empower the community and stakeholders, giving them voting rights in the protocol’s decision-making process. Below is a detailed look at the tokenomics of DBR, including its total supply, distribution strategy, and incentives for staking or holding DBR.

Total Supply

The total supply of DBR tokens is capped at 10,000,000,000 DBR, ensuring scarcity and value preservation over time. The token is designed with a structured and transparent distribution plan that will gradually release tokens to various stakeholders involved in the deBridge ecosystem.

Distribution Strategy

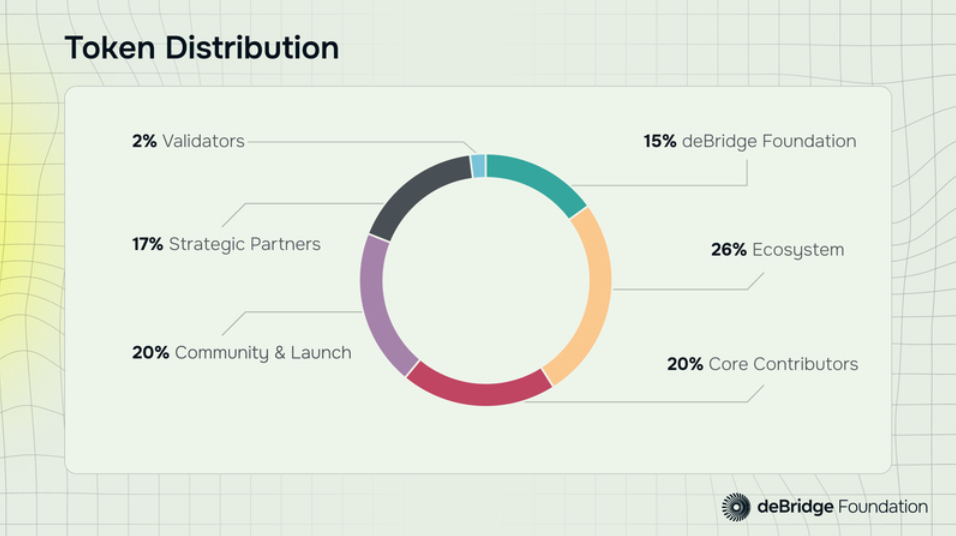

The DBR token distribution is carefully designed to balance incentives for community participation, core contributors, strategic partners, and validators. Here’s how the total supply is allocated:

- Community & Launch (20%) — 2,000,000,000 DBR

This portion is reserved for community initiatives, including airdrop programs, and will be distributed across future deBridge campaigns. The distribution strategy includes:- 10% unlocked at TGE (Token Generation Event)

- Season 1 airdrop (6%)

- LFG Vault (2%)

- Jupiter LFG Reward (1%)

- Meteora Pool (1%)

The remainder will be subject to 3-year quarterly vesting, starting 6 months after TGE (Token Generation Event).

- Ecosystem (26%) — 2,600,000,000 DBR

The Ecosystem portion of the token distribution is controlled by the governance multisig and will be used to support ecosystem activities that contribute to the growth of deBridge. This includes initiatives like developer community growth, grants, and ecosystem incentives.- 300,000,000 DBR will be unlocked at TGE.

- The remainder will be subject to 3-year quarterly vesting, starting 6 months after TGE.

- Core Contributors (20%) — 2,000,000,000 DBR

This portion of DBR is allocated to the core contributors who have played a crucial role in building and maintaining the deBridge protocol over the years.- 400,000,000 DBR (4% of total DBR supply) will be unlocked 6 months after TGE.

- The rest of DBR will be vested quarterly over 3 years.

- deBridge Foundation (15%) — 1,500,000,000 DBR

The deBridge Foundation treasury holds 15% of the total supply, which will be used to grow liquidity and support the development of the deBridge ecosystem. These tokens are intended to help fund long-term incentive programs and protocol growth.- 500,000,000 DBR (5% of total DBR supply) will be unlocked at TGE.

- The remainder will be subject to 3-year quarterly vesting, starting 6 months after TGE.

- Strategic Partners (17%) — 1,700,000,000 DBR

Strategic Partners who helped bootstrap the deBridge protocol during its early stages are allocated 17% of the token supply. These tokens reward angels, investors, and supporters who have contributed to deBridge’s success.- 340,000,000 DBR (3.4% of total DBR supply) will be unlocked 6 months after TGE.

- The rest of DBR will be vested quarterly over 3 years.

- Validators (2%) — 200,000,000 DBR

Validators are essential to ensuring the operational resilience of deBridge’s cross-chain messaging infrastructure. This portion is designed to reward validators for their ongoing contributions to maintaining the protocol’s security and uptime.- 40,000,000 DBR (0.4% of total DBR supply) will be unlocked 6 months after TGE.

- The remainder will be vested quarterly over 3 years, contingent upon their performance and reliability.

Incentives for Holding and Staking DBR

Holding or staking DBR offers multiple incentives for participants in the deBridge ecosystem:

- Governance Participation

DBR token holders gain voting power, enabling them to participate in key governance decisions regarding the protocol’s future upgrades and ecosystem initiatives. - Staking Rewards

By staking DBR tokens, users can earn additional rewards, thereby incentivizing long-term engagement and commitment to the deBridge ecosystem. - Liquidity Mining

Liquidity providers can stake DBR to support DeFi liquidity pools across various blockchains. In return, they receive a share of the platform’s transaction fees and other liquidity incentives. - Network Security

Validators who participate in securing the deBridge network by validating transactions are rewarded with DBR tokens. This creates a secure and decentralized network infrastructure while also providing validators with incentives for their continued work. - Community Engagement

As part of the community, users can participate in various campaigns and earn DBR tokens through activities like airdrops, loyalty programs, and referral initiatives.

Key Metrics

- Market Cap: $58,387,305 USD

- Fully Diluted Value: $325,153,900 USD

- Circulating Supply: 1,800,000,000 DBR

- Max Supply: 10,000,000,000 DBR

- Percentage of Max Supply Released: 18.00%

The tokenomics of DBR ensures that the token remains a valuable asset within the deBridge ecosystem, promoting decentralization, network security, and long-term growth while rewarding active participation and community involvement.

Source: https://docs.debridge.foundation/faq-airdrop-season-1/dbr-tokenomics

Why is DeBridge Important for DeFi?

The rise of decentralized finance (DeFi) has brought about a need for interoperability between different blockchain ecosystems. DeBridge addresses this challenge by enabling users to perform cross-chain swaps and manage liquidity seamlessly. Let’s explore why deBridge is so crucial for the future of DeFi.

Addressing Liquidity Fragmentation

One of the major issues in DeFi today is liquidity fragmentation. Liquidity is spread across different blockchains and platforms, making it difficult for users to access the best prices. DeBridge solves this issue by enabling cross-chain liquidity across multiple networks, ensuring that users can access liquidity wherever it is needed.

Enabling Multi-Chain dApps

With the rise of multi-chain dApps, it is important to have a protocol that can handle cross-chain interactions. DeBridge makes it possible for developers to build multi-chain decentralized applications (dApps) by providing the tools and infrastructure needed to interact with multiple blockchains seamlessly.

Expanding DeFi Use Cases

DeBridge has the potential to expand the use cases of DeFi by facilitating new financial products and services that were previously impossible due to the limitations of single-blockchain platforms. With deBridge, DeFi applications can now leverage the strengths of multiple blockchains to create more robust and diverse financial ecosystems.

DeSwap Liquidity Network: A Closer Look

The DeSwap Liquidity Network (DLN) is a key feature of deBridge that deserves special attention. It enables users to place limit orders and fulfill them across different blockchains. By leveraging the liquidity of the DLN, users can maximize their chances of getting the best prices while executing cross-chain transactions.

How DLN Works

DLN allows users to place an order on the source chain, and solvers on the destination chain can fulfill the order by supplying the requested tokens. Once the order is fulfilled, the corresponding asset is transferred to the user’s wallet. The entire process is automated and secured by smart contracts, ensuring a smooth transaction.

Advantages of DLN

The main advantage of the DLN is its ability to provide liquidity across multiple chains without requiring users to lock their assets into liquidity pools. This decentralized approach ensures that liquidity remains fluid, making it easier for users to trade assets at competitive prices.

Security and Decentralization in DeBridge

DeBridge places a strong emphasis on security and decentralization, two pillars that are critical in the DeFi space.

Validator Network

The validator network plays a crucial role in ensuring the integrity and security of the deBridge protocol. Validators are responsible for confirming transactions and maintaining the overall health of the network.

Audit and Risk Mitigation

DeBridge undergoes regular audits to ensure the safety of its smart contracts and infrastructure. The platform also has mechanisms in place for risk mitigation, protecting users from potential threats and vulnerabilities.

Phishing Incident (2023)

In 2023, deBridge faced a phishing incident that led to a temporary disruption in service. However, the team responded quickly, implementing additional security measures to prevent similar incidents in the future.

Use Cases of DeBridge

DeBridge opens up a wide range of use cases for cross-chain applications, including:

Cross-Chain DeFi

DeBridge allows users to execute cross-chain DeFi transactions seamlessly, enabling liquidity and asset transfers between various blockchains.

NFT Transfers

The DeBridge protocol also facilitates NFT transfers across blockchains. It makes easier for users to move their assets between different platforms.

DAO Governance

DeBridge can be used to facilitate DAO governance by enabling decentralized organizations to interact across different blockchains.

Gaming and Metaverse

DeBridge plays a significant role in the gaming and metaverse industries by enabling seamless asset transfers and interactions between different virtual worlds.

Challenges and Risks in Cross-Chain Solutions

Despite its many advantages, cross-chain solutions come with their own set of challenges and risks.

Liquidity and Scalability

Ensuring sufficient liquidity and scalability across multiple blockchains can be challenging. DeBridge addresses this by leveraging its DeSwap Liquidity Network (DLN).

Security Concerns

Security remains a major concern in cross-chain operations, and deBridge has implemented various measures to mitigate risks.

Regulatory Considerations

As cross-chain solutions gain popularity, they may face increased regulatory scrutiny. deBridge is committed to ensuring compliance with existing regulations while promoting decentralization.

Future Roadmap for DeBridge

The future of deBridge looks promising, with plans for continued growth and innovation.

Expansion Plans

DeBridge is focused on expanding its cross-chain liquidity and enhancing the DeFi ecosystem by adding more supported blockchains and improving its infrastructure.

Focus on Modular Interoperability

The team is working on developing modular interoperability, allowing users to interact with multiple blockchains in a more flexible and scalable manner.

Partnerships and Ecosystem Growth

DeBridge aims to forge new partnerships and expand its ecosystem, contributing to the growth of DeFi.

Potential Role in Layer 3 Solutions

In the future, deBridge may play a key role in Layer 3 solutions, further improving scalability and interoperability in the blockchain space.

Conclusion: DeBridge as the Future of Cross-Chain Interoperability

As the blockchain ecosystem continues to expand, cross-chain interoperability has become a pivotal issue for developers and users alike. deBridge Finance stands out in this space by providing robust solutions for cross-chain liquidity, asset transfers, and messaging, helping to bridge the gap between different blockchain networks. The project’s focus on enabling seamless transactions and integrating multiple blockchains positions it at the forefront of the growing demand for interoperability in the decentralized finance (DeFi) world.

With its advanced DeSwap Liquidity Network (DLN) and focus on decentralized governance, deBridge is creating a more interconnected and scalable blockchain ecosystem. These solutions are crucial for empowering decentralized applications (dApps) and enabling new use cases such as cross-chain DeFi, NFT transfers, and DAO governance.

However, deBridge isn’t alone in its mission to improve cross-chain interactions. Rubic, with its Cross-Chain Crypto Exchange and Bridge API, also plays a vital role in the broader interoperability ecosystem. While deBridge focuses on liquidity and asset transfers across chains, Rubic’s API allows seamless integration of cross-chain exchanges and bridge functionalities. This enables users to swap assets between chains easily, enhancing the DeFi experience by offering additional tools for cross-chain asset management.

By leveraging Rubic’s API, projects can access a wider variety of cross-chain swap and bridge options, further complementing the core functionality offered by deBridge. In this way, Rubic and deBridge both contribute to the decentralized interoperability movement, offering users multiple pathways to achieve a fully interconnected blockchain ecosystem.