What Is Across Protocol? A Deep Dive by Rubic

TL;DR

- Across Protocol is an intent-based cross-chain bridge that enables fast, secure, and cost-efficient value transfers across 15+ blockchain networks, including Ethereum, Polygon, and Optimism.

- Its innovative architecture uses user-defined intents and a three-layered process to optimize transaction speed and efficiency.

- The ACX token underpins the ecosystem, supporting governance, rewards, and transaction fees.

- Across Protocol addresses challenges like liquidity fragmentation and interoperability while enabling new DeFi use cases like cross-chain dApps and instant asset transfers.

The rapid growth of decentralized finance (DeFi) has created a pressing need for efficient, seamless interoperability across blockchains. Across Protocol stands out as an innovative solution, addressing this challenge with a unique intents-based architecture. This article will help you understand how Across Protocol works, its defining features, the tokenomics of the ACX token, and the broader impact it has on the DeFi space.

What is Across Protocol?

Across Protocol is an intent-based cross-chain bridge designed to provide fast, secure, and cost-efficient value transfers across multiple blockchain networks. Supporting ten blockchains, including Ethereum, Arbitrum, Polygon, zkSync, and Optimism, it addresses the need for frictionless interoperability in the DeFi space.

The protocol operates on an intents-based framework, where transactions are executed based on user-defined intents, ensuring precision and optimizing efficiency.

In 2023, Across Protocol processed transfers with an average fee of less than $1 for 1 ETH, while maintaining transaction completion times under one minute. These statistics highlight its affordability and speed, making it a reliable solution for developers, liquidity providers, and users alike.

How Across Protocol Works

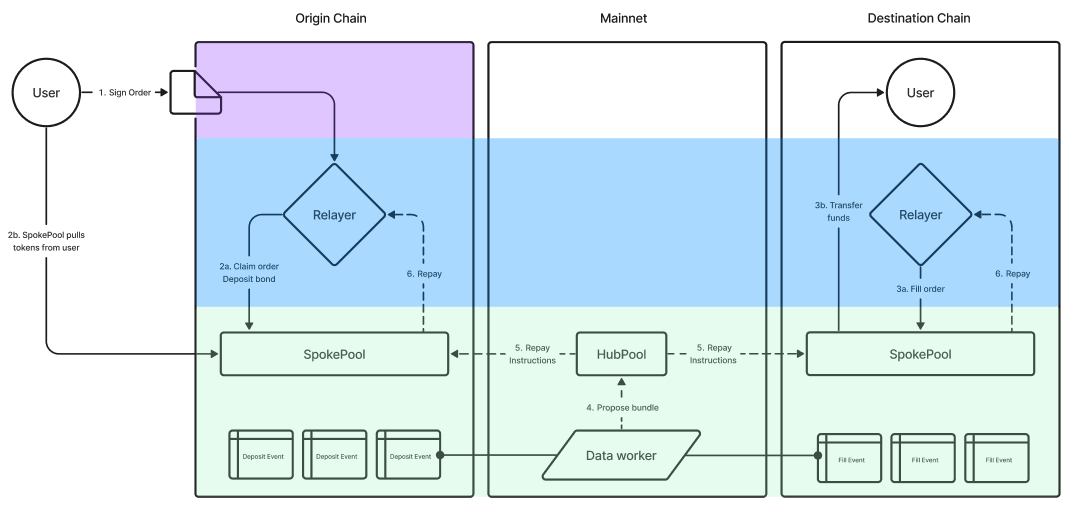

To understand the mechanics behind Across Protocol’s seamless cross-chain transfers, it’s essential to explore its innovative intents-based architecture and the three-layered transaction process that powers its speed, security, and efficiency.

Intents-Based Architecture

The foundation of Across Protocol lies in its intents-based model, where each transaction begins with a user-defined intent. This intent specifies the transfer’s parameters, including the asset, source chain, destination chain, and transaction amount.

source: https://docs.across.to/concepts/intents-architecture-in-across

Transaction Process: Three Core Layers

1. Initiating a Transfer (Request for Quote – RFQ):

A user initiates a transaction by generating a Request for Quote (RFQ). This RFQ signals the network about the user’s intent and invites relayers to respond with the best offer.

2. Relayer Network and Matching:

The protocol’s decentralized relayer network matches user requests with liquidity providers who facilitate the transfer. Relayers ensure transaction speed and cost-effectiveness while minimizing security risks.

3. Settlement and Finalization:

Once the relayer processes the transaction, the assets are securely settled on the destination chain through the settlement layer.

This layered approach enhances efficiency, allowing the protocol to achieve average transaction speeds of under one minute.

source: https://docs.across.to/introduction/what-is-across

Key Features of Across Protocol

Across Protocol stands out in the competitive world of blockchain technology by offering a range of features that prioritize speed, cost-efficiency, security, and developer accessibility. Here’s a detailed look at what makes Across Protocol a top choice for cross-chain transactions:

Speed and Cost Efficiency

One of the standout features of Across Protocol is its unmatched transaction efficiency. Transfers, such as 1 ETH, are processed with fees as low as $1 and completed in under a minute. This speed and affordability make it an attractive option for both individual users and institutions seeking fast and economical cross-chain swaps.

Multi-Chain Support

Across Protocol supports 15+ blockchain networks, including industry giants like Ethereum, zkSync, Base, and Optimism. This extensive multi-chain compatibility allows users to seamlessly transfer assets across various ecosystems, empowering decentralized applications to reach broader audiences and ensuring flexibility in asset management.

Secure Architecture

Security is at the core of Across Protocol’s design. The protocol leverages a decentralized intent infrastructure that minimizes vulnerabilities typically associated with centralized systems. By doing so, it ensures the safety of user funds during transactions, offering a reliable solution for cross-chain asset transfers.

Developer-Friendly Infrastructure

Across Protocol provides a scalable and adaptable framework that is ideal for developers building multi-chain dApps. Its intent-based architecture and robust infrastructure make it easier for developers to integrate cross-chain functionalities into their projects, accelerating innovation within the decentralized finance (DeFi) space.

Sustainability and Reliability

Across Protocol’s strategic partnerships, such as with Rubic, enhance the network’s operational security and reliability. These collaborations ensure the protocol’s long-term sustainability while maintaining its performance and delivering seamless user experiences.

Tokenomics of ACX Token

The ACX token serves as the backbone of the Across Protocol ecosystem. It supports various functions, including governance, transaction fee payments, and rewards for participants. Below is a breakdown of its tokenomics:

ACX Token Supply and Distribution

- Max Supply: 1,000,000,000 ACX

- Circulating Supply: 443,956,536.36 ACX

- Market Capitalization: $186,181,279

- Fully Diluted Value: $422,981,000

Distribution of ACX Tokens

- Across DAO Treasury Reserve: 52.5% of the total supply is allocated to the DAO’s treasury, ensuring long-term sustainability.

- Strategic Partnerships and Fundraising: 25% is earmarked for strategic initiatives, including partnerships and fundraising efforts.

- Airdrop Distribution: 12.5% of tokens are allocated for airdrops, incentivizing user adoption and rewarding early contributors.

- Protocol Rewards: 10% of the supply is dedicated to rewarding relayers and liquidity providers who play a critical role in the network’s operations.

Token Lock Status

- Total Locked Tokens: 250 million ACX (25% of the total supply).

- TBD Locked Tokens: 625 million ACX (62.5%).

- Unlocked Tokens: 125 million ACX (12.5%), available for circulation and active use.

Security and Reliability

Across Protocol prioritizes security by leveraging decentralized relayers and a robust settlement layer. Its partnership with Clip Finance enhances transaction reliability, ensuring users can execute seamless transfers without concerns about vulnerabilities.

Importance of Across Protocol in DeFi

Addressing Fragmented Liquidity

One of the most significant challenges in DeFi is liquidity fragmentation across multiple blockchains. Across Protocol addresses this issue by providing a seamless bridge, consolidating liquidity, and ensuring efficient transfers.

Enabling Multi-Chain Innovation

By simplifying cross-chain transactions, Across Protocol empowers developers to create innovative dApps that operate seamlessly across chains, expanding the possibilities for DeFi use cases.

Lowering Entry Barriers

The protocol’s low fees and fast processing times make it an attractive solution for users and developers, democratizing access to DeFi for a global audience.

Use Cases of Across Protocol

Across Protocol’s innovative design and features make it a powerful tool for a variety of decentralized finance (DeFi) applications. By enabling seamless, secure, and cost-effective cross-chain asset transfers, it addresses the growing need for interoperability in the blockchain ecosystem. Here’s a detailed look at its key use cases:

1. Instant Asset Transfers Across Blockchains

Across Protocol excels in enabling fast and low-cost asset transfers across multiple blockchains. This capability is especially useful for traders and liquidity providers looking to quickly adjust their positions or move funds across chains to capitalize on opportunities.

2. DeFi Liquidity Sourcing for Protocols

DeFi protocols rely heavily on liquidity to function effectively. Across Protocol’s interoperability allows these protocols to source liquidity from multiple chains without creating fragmented pools. This ensures better liquidity utilization and reduced slippage, enhancing the overall efficiency of DeFi platforms.

3. Payment and Remittance Services

With its cost-effective and fast transaction processing, Across Protocol is well-suited for payment and remittance services. Users can send payments across borders by leveraging different blockchains, bypassing traditional financial intermediaries, and saving on fees and time. This makes it a valuable tool for global remittance companies looking to modernize their operations using blockchain technology.

Challenges and Risks

While Across Protocol offers several advantages, it is not without challenges:

- Liquidity Management: Ensuring adequate liquidity across all supported blockchains is critical for its success.

- Market Competition: Competing cross-chain solutions may pose a challenge as the DeFi ecosystem grows.

- Regulatory Uncertainty: The evolving regulatory environment for DeFi could impact the protocol’s adoption and growth.

Future Roadmap

Across Protocol aims to expand its blockchain support, enhance its governance model, and introduce advanced features to optimize its relayer network. These developments will ensure its continued relevance in the ever-evolving DeFi ecosystem.

Conclusion

Across Protocol stands out in the blockchain space, addressing critical challenges such as liquidity fragmentation, high transaction costs, and the need for interoperability across multiple chains. Its intents-based architecture and multi-layered transaction process make it a powerful solution for seamless cross-chain asset transfers. With key features like speed, cost-efficiency, multi-chain support, and security, the protocol has solidified its role in driving innovation within decentralized finance (DeFi).

From enabling instant cross-chain asset transfers to enhancing liquidity sourcing for DeFi protocols and powering cross-chain dApps, Across Protocol is unlocking new possibilities for users and developers alike.

Looking ahead, Across Protocol’s impact is poised to grow even further, especially as the DeFi ecosystem continues to expand. With its user-focused approach and innovative solutions, the protocol is well-positioned to support new use cases, improve accessibility, and drive blockchain adoption globally.

FAQs

1. What makes Across Protocol unique?

Its intents-based architecture and decentralized relayer network ensure fast, secure, and affordable cross-chain transactions.

2. How are ACX tokens distributed?

52.5% of the total supply is allocated to the Across DAO Treasury Reserve, 25% to strategic partnerships, 12.5% to airdrops, and 10% to protocol rewards.

3. What chains are supported by Across Protocol?

The protocol supports 15+ prominent blockchains, including Ethereum, Polygon, zkSync, and Optimism.